Reports

The Callan Periodic Table of Investment Returns

The Callan Periodic Table of Investment Returns

From: Callan

The Callan Periodic Table of Investment Returns conveys the strong case for diversification across asset classes (stocks vs bonds), investment styles (growth vs value), capitalizations (large vs small), and equity markets (U.S. vs non-U.S.). The Table highlights the uncertainty inherent in all capital markets. Rankings change every year. Also noteworthy is the difference between absolute and relative performance, as returns for the top-performing asset class…

The Importance of Income & Diversification

The Importance of Income & Diversification

From: MFS

Chasing yield and return in your fixed income investments whether it’s before taxes or based on tax equivalent yields could leave your portfolio overly correlated to stocks.

The following chart shows five-year monthly correlations and yields of fixed income categories compared to the S&P 500 as of 6/30/18.

Real Time US National Debt Clock

The US National Debt matters because higher debt results in: higher taxes, reduced ‘benefits’ and programs, higher interest rates, and a weak dollar. All of which will make the United States a much weaker and less free nation. It is stealing from the future by spending their money today and reducing growth now which hurts everyone in coming years.

“USADebtClock.com is the current incarnation of our debt monitoring efforts. Begun in 1987 with…

What is Alpha?

What is Stock Beta?

Economic Update – February 12th, 2018

February 12th, 2018 – Economic Update

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

WALL STREET SEES ITS FIRST CORRECTION SINCE 2016

On Friday, the S&P 500 settled at 2,619.55, down 5.16% for the week. Thursday, it entered correction territory just nine days after its January 26 record close. The Dow Jones Industrial Average made even bigger headlines last week by taking two 1,000-point drops within four days, the…

What is Deflation in under 3 Minutes

Deflation is when the price of a basket of goods declines. It’s the opposite of inflation. A common tool used to track deflation is the CPI or Consumer Price Index.

What is Inflation in under 3 Minutes

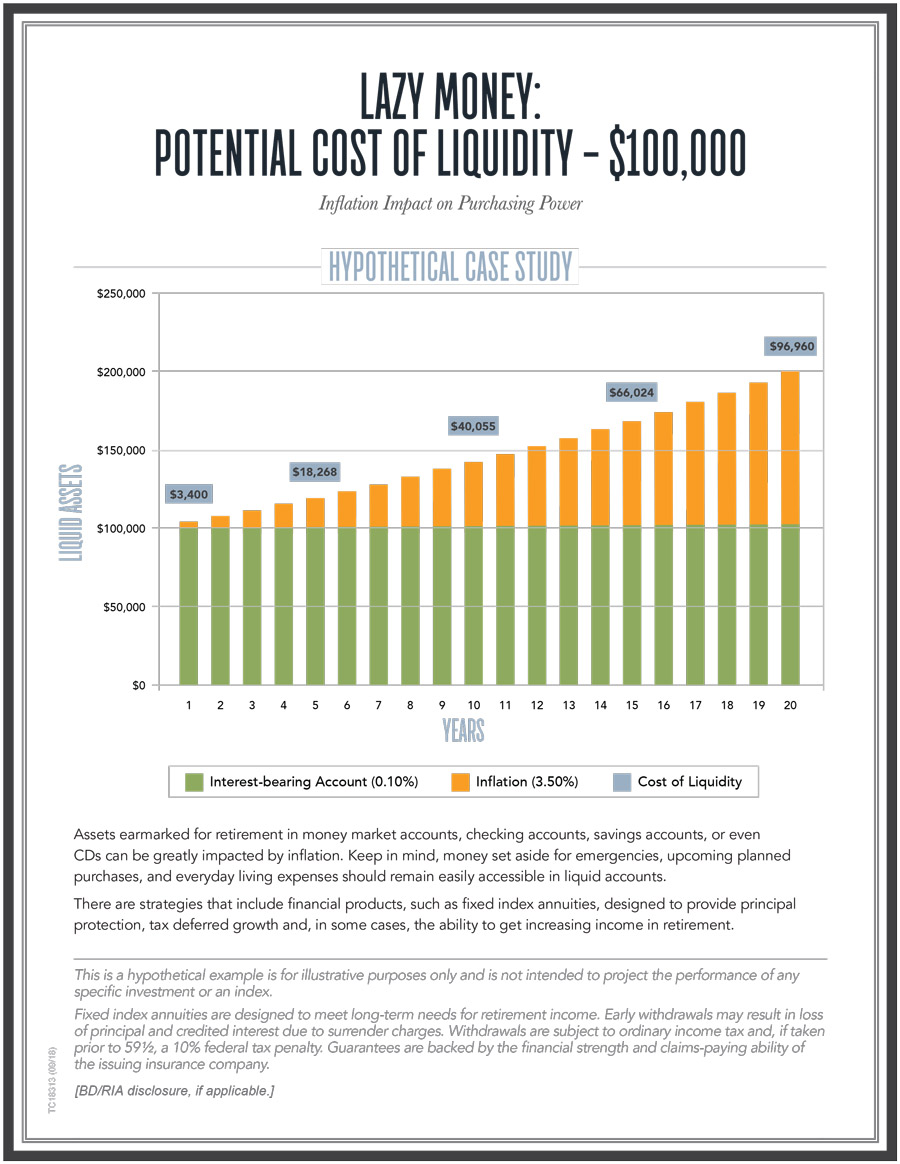

Inflation is when prices on normal goods and services moves higher over time. A common tool used to track inflation is the CPI or Consumer Price Index.

Forbes 2018 Tax Guide

The Internal Revenue Service has announced the annual inflation adjustments for a number of taxrelated provisions for 2018, including, of course, the latest tax rate schedules and tax tables. These are the numbers for the tax year 2018 beginning January 1, 2018 (assuming there are no big changes as the result of tax reform). They are not the numbers and tables that…