It may sound like common sense, or even cliché, but many who were born in the 1930’s or 1940’s grew up listening to parents discuss the “stock market” as a source of destruction and loss. As a result, those retirees may seek to “fix” their income in a world where the cost of lifestyle sustaining goods increases year after year. The problem is exacerbated in traditional systematic withdrawal programs when retiring at a market…

Reports

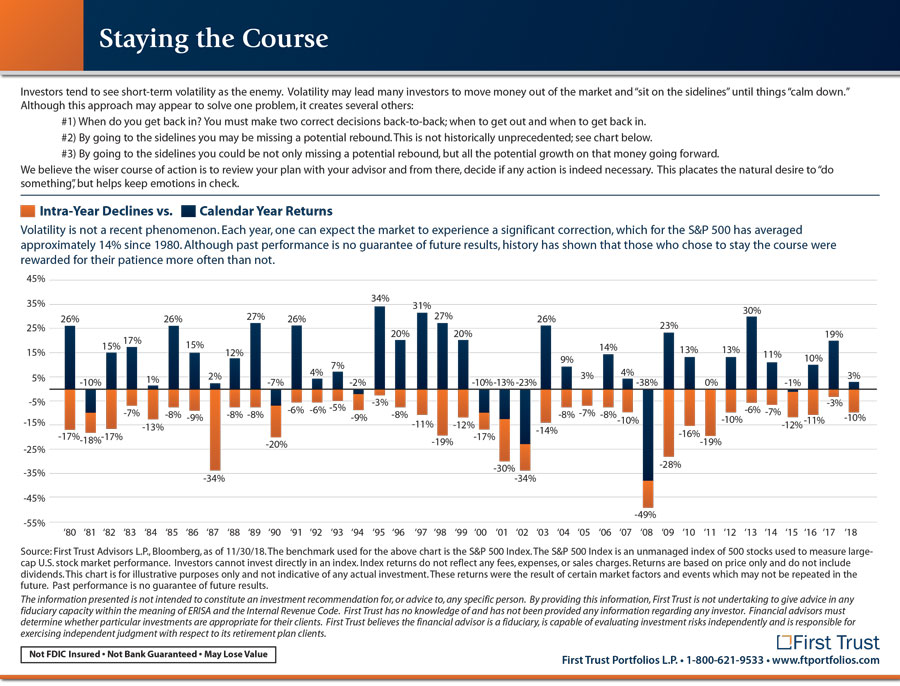

Staying the Course

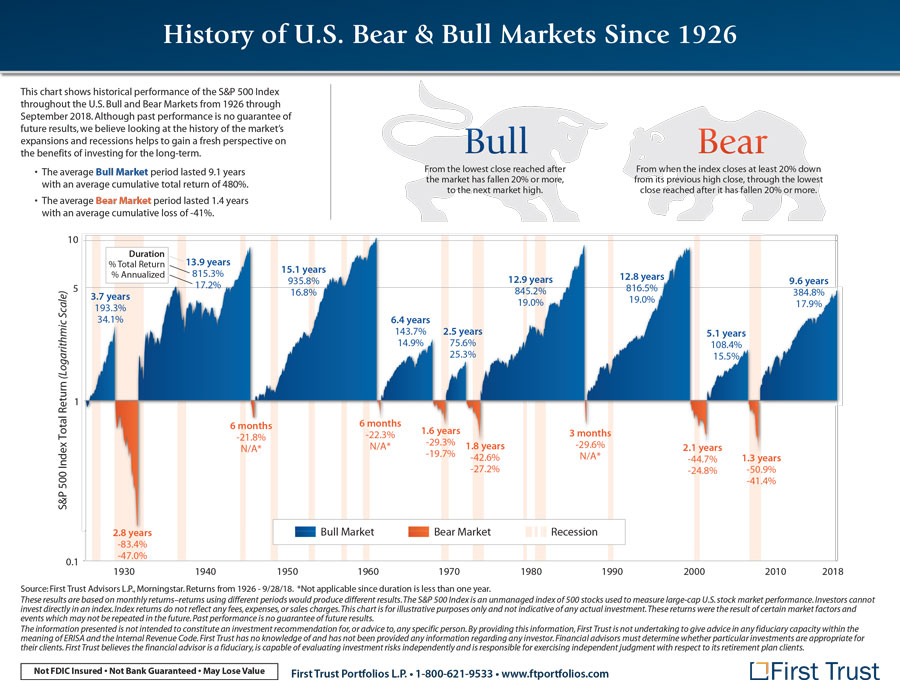

History of U.S. Bear & Bull Markets since 1926

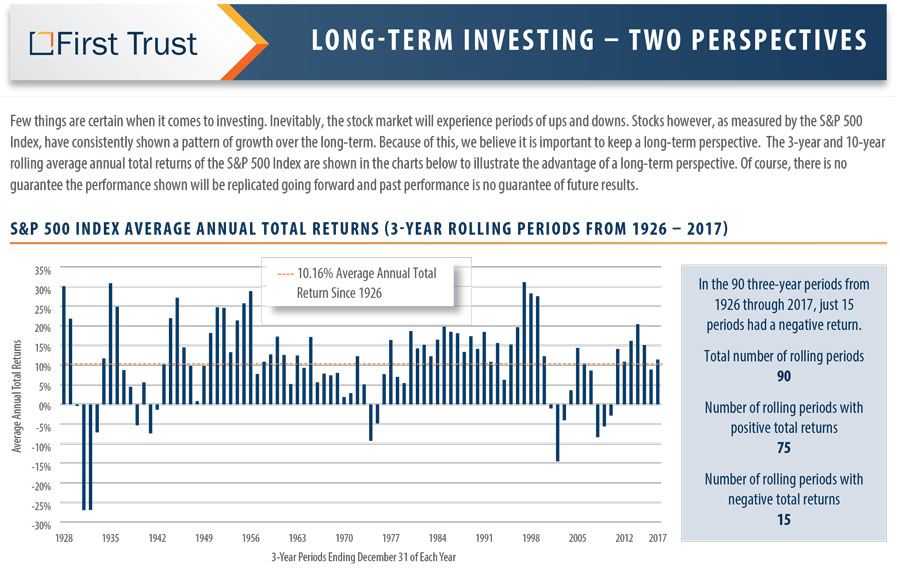

Long-term Investing – Two Perspectives

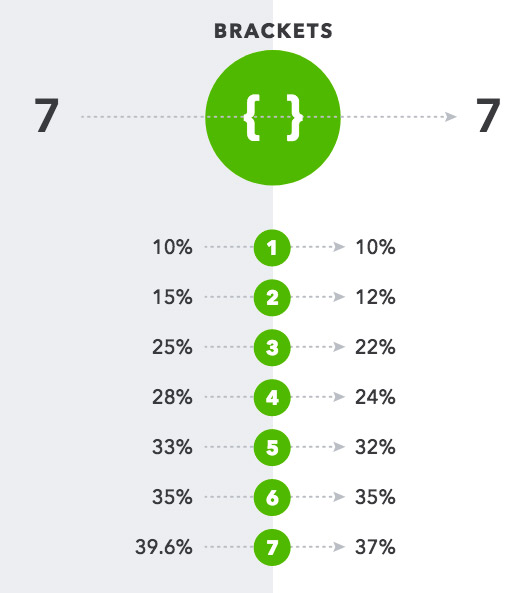

The Big Picture of 2018 Tax Changes

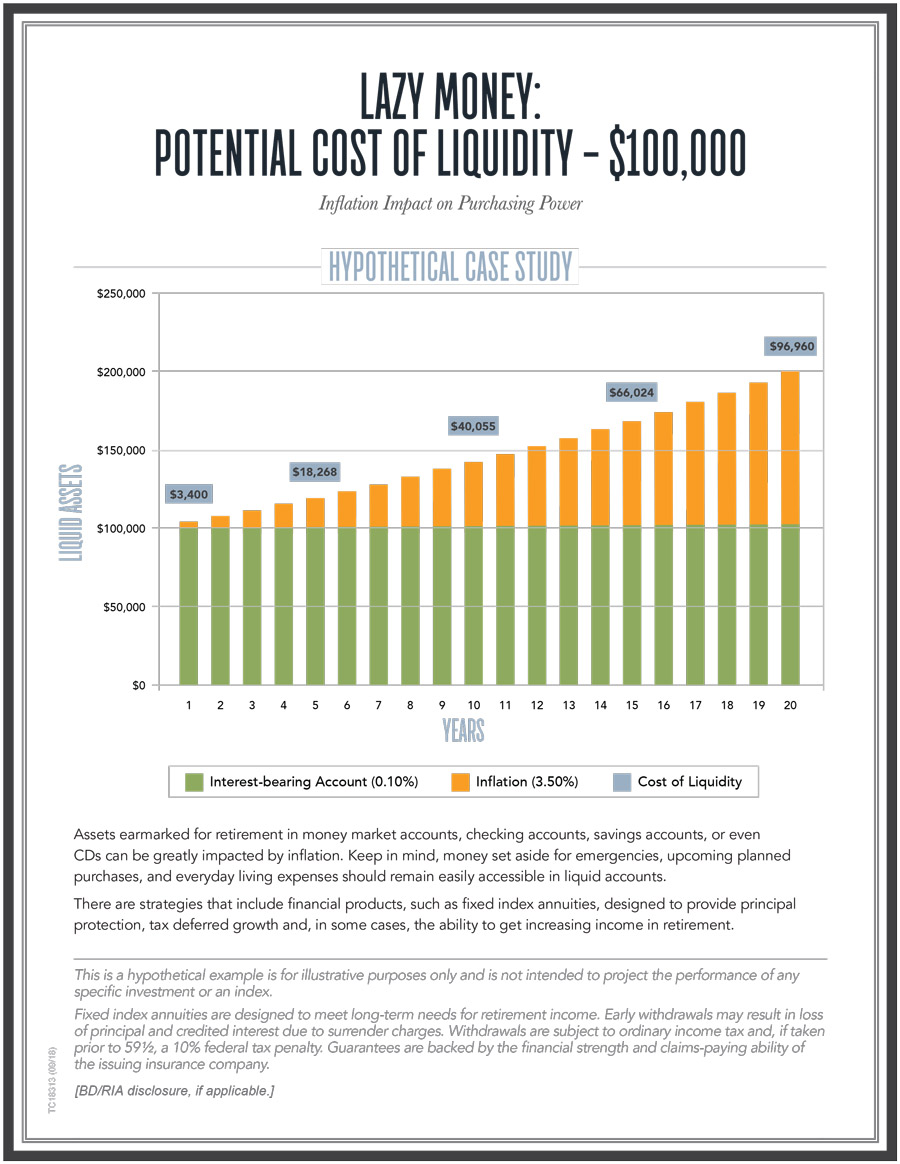

Potential Cost of Liquidity

The Callan Periodic Table of Investment Returns

The Callan Periodic Table of Investment Returns

From: Callan

The Callan Periodic Table of Investment Returns conveys the strong case for diversification across asset classes (stocks vs bonds), investment styles (growth vs value), capitalizations (large vs small), and equity markets (U.S. vs non-U.S.). The Table highlights the uncertainty inherent in all capital markets. Rankings change every year. Also noteworthy is the difference between absolute and relative performance, as returns for the top-performing asset class…

The Importance of Income & Diversification

The Importance of Income & Diversification

From: MFS

Chasing yield and return in your fixed income investments whether it’s before taxes or based on tax equivalent yields could leave your portfolio overly correlated to stocks.

The following chart shows five-year monthly correlations and yields of fixed income categories compared to the S&P 500 as of 6/30/18.

Real Time US National Debt Clock

The US National Debt matters because higher debt results in: higher taxes, reduced ‘benefits’ and programs, higher interest rates, and a weak dollar. All of which will make the United States a much weaker and less free nation. It is stealing from the future by spending their money today and reducing growth now which hurts everyone in coming years.

“USADebtClock.com is the current incarnation of our debt monitoring efforts. Begun in 1987 with…