Investment/Asset Allocation

Horizon Investments: Risk Assist Explained

REAP’s affiliate strategist Horizon Investments introduces

“Risk Assist” for investment risk mitigation.

How to Prepare Portfolios for Rising Interest Rates

How to Prepare Portfolios for Rising Interest Rates

From: FlexShares.com

Historical data helps identify assets that may be positioned to fare well when higher rates threaten fixed-income and equity returns

For a good illustration of how investors typically react to the prospect of higher interest rates, look at what happened in January 2022. News that the US Federal Reserve (Fed) might begin raising rates as early as March sparked market volatility that…

It’s natural to see ebbs and flows in the market as we enter a new era of monetary policy

It’s natural to see ebbs and flows in the market as we enter a new era of monetary policy

From: www.marketwatch.com

The S&P 500 suffered its worst start to a year, in the first four months of 2022, in over 80 years.

Three major U.S. indexes plunged again on Thursday as investors got tripped by a hawkish Federal Reserve’s fight against inflation amid fears of a hard-landing.

As…

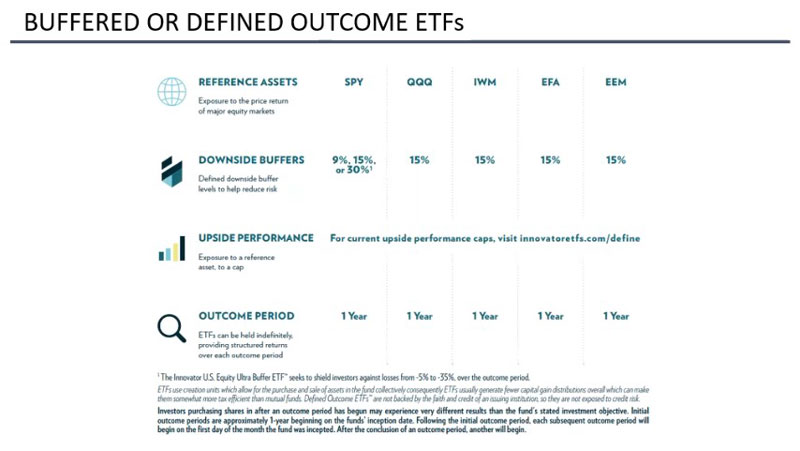

BCM Buffer Series March 2022

Expand Your Core: Constructing a Bond Portfolio to Prosper in Changing Environments

Expand Your Core: Constructing a Bond Portfolio to Prosper in Changing Environments

From: Ocean Park Asset Management

Executive Summary:

• Just as the S&P 500 Index is the “go-to” benchmark for U.S. stocks, the Bloomberg Barclays U.S. Aggregate Bond Index (often called the “Agg”) acts as the go-to index for core U.S. bonds.

• U.S. 10-year Treasury rates have fallen for the past 40 years from a high of over 15% to 1.3%…

Why You Should Be a Risk-Taker

Why You Should Be a Risk-Taker

From: www.morningstar.com

Since you can’t really avoid risk, you might as well take control of the situation.

Risk, it seems, is a four-letter word.

That’s true in the literal sense, of course. But it’s also no stretch to say risk carries a negative connotation for investors. True, the market is clipping along in 2021 (the S&P 500 is up more than 8% as of early April, on…

5 Issues for Bond Investors to Consider: Wells Fargo

5 Issues for Bond Investors to Consider: Wells Fargo

From: www.thinkadvisor.com

Fixed income has an important role to play in a well-diversified portfolio, even in today’s rising interest rate environment, according to a new report from Wells Fargo Investment Institute.

The report puts forward five characteristics of bonds it says investors should consider before they make changes to their bond holdings.

1. Performance

Investors should judge fixed income performance by…

9 Ways to Protect Your Retirement Income When Markets Are Volatile

9 Ways to Protect Your Retirement Income When Markets Are Volatile

From: www.retirementplanning.net

Most people rely on their retirement savings accounts, such as a 401(k) account or an IRA (individual retirement account), for the non-working years of their life. While these plans supplement Social Security benefits, they are also prone to market volatility. A downturn in the market could have severe implications on your retirement income from these accounts. But since…

4 Things You Can Do to Adapt Your Financial Plan to Market Fluctuations

4 Things You Can Do to Adapt Your Financial Plan to Market Fluctuations

From: www.financialadvisor.net

Markets are dynamic and continually change owing to a variety of global and domestic factors. These market fluctuations can have a considerable impact on general investment strategies and a portfolio’s worth. A market swing in the positive direction can increase the reward for investors, while a downward strike can augment the risk and reduce overall returns….