Just How Dumb Are Investors?

From: The Wall Street Journal

Investors may not be as stupid as some researchers think, but they still need to fight their own fear and greed.

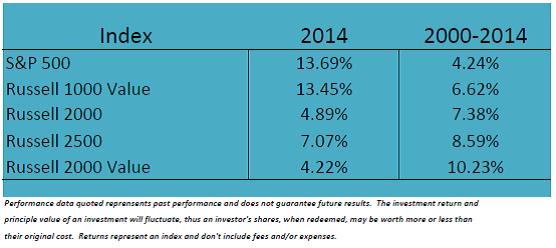

A new study finds that the average investor in all U.S. stock funds earned 3.7% annually over the past 30 years—a period in which the S&P 500 stock index returned 11.1% annually. That means stock-fund investors underperformed the market by approximately 7.4 percentage…