Business Insider • REMINDER: You Are ‘Shockingly’ Terrible At Investing

Most people are just terrible at investing. One big problem is that investors often find themselves buying at highs and selling at lows, especially when volatility picks up and patience is tested.

“Amidst difficult financial times, emotional instincts often drive investors to take actions that make no rational sense but make perfect emotional sense,” said BlackRock back in 2012. “Psychological factors such as fear often translate into poor timing of buys and sells.”

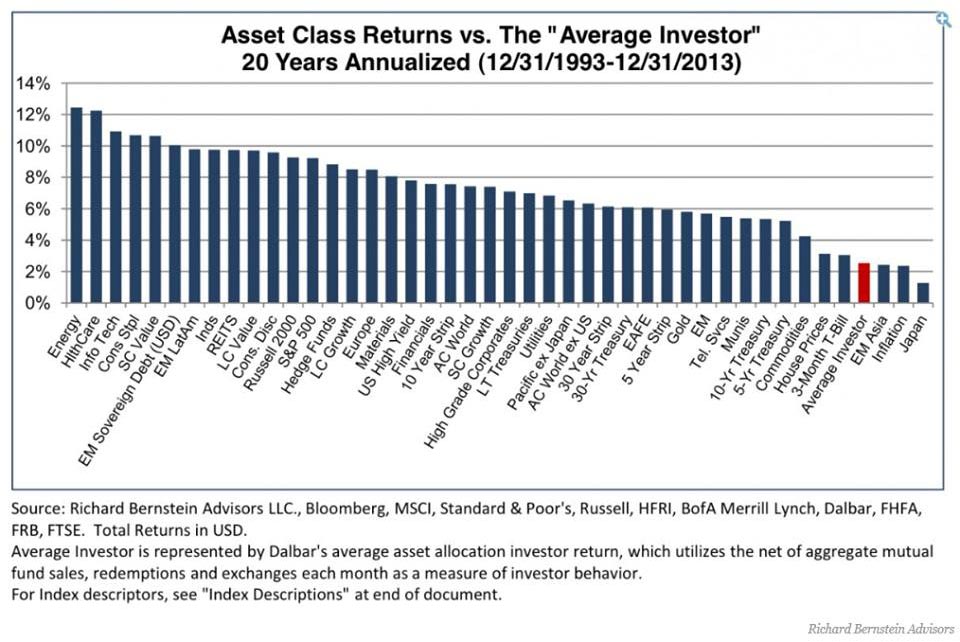

Richard Bernstein of Richard Bernstein Advisors considers twenty years of historical data for this in a new research note.

“The performance of the typical investor over this time period is shockingly poor,” wrote Bernstein. “The average investor has underperformed every category except Asian emerging market and Japanese equities. The average investor even underperformed cash (listed here as 3-month t-bills)! The average investor underperformed nearly every asset class. They could have improved performance by simply buying and holding any asset class other than Asian emerging market or Japanese equities. Thus, their underperformance suggests investors’ timing of asset allocation decisions must have been particularly poor, i.e., investors consistently bought assets that were overvalued and sold assets that were undervalued.”

Bernstein’s data is based on the buying and selling activity of mutual fund investors.

“They bought high and sold low,” he added. “When chaos occurred, investors ran away.”