A Guide to Turning 65

From: www.mutualofomaha.com

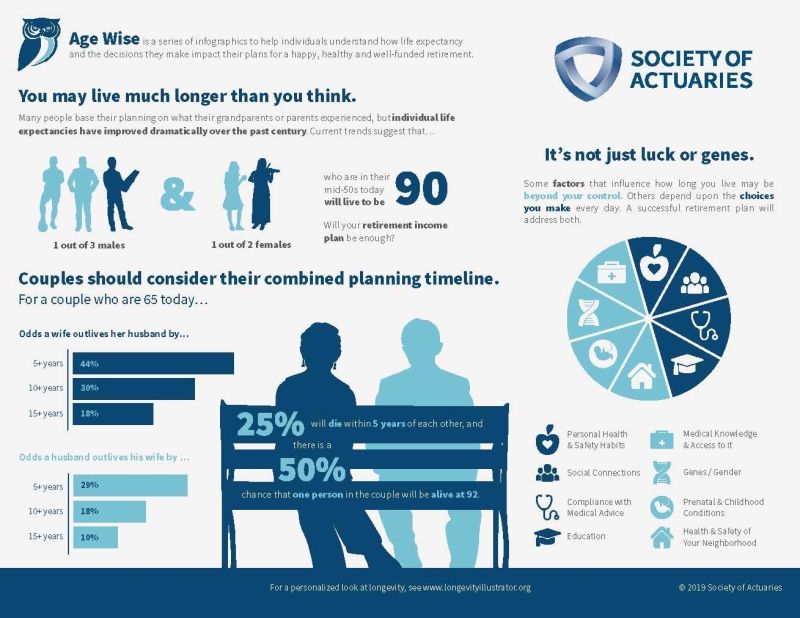

According to a 2019 U.S. Census Bureau report, more than 10,000 people in the U.S. turn 65 every day a number that’s only going to grow over the next five years. In addition to being the age at which Americans become eligible for Medicare, 65 has long been regarded as the traditional age for retirement. But as we’re living longer, and in many…