Brian Ortiz: Venture Capital vs. Private Equity

From: www.linkedin.com

I’m utilizing two separate sources for this post as both complement each other nicely:

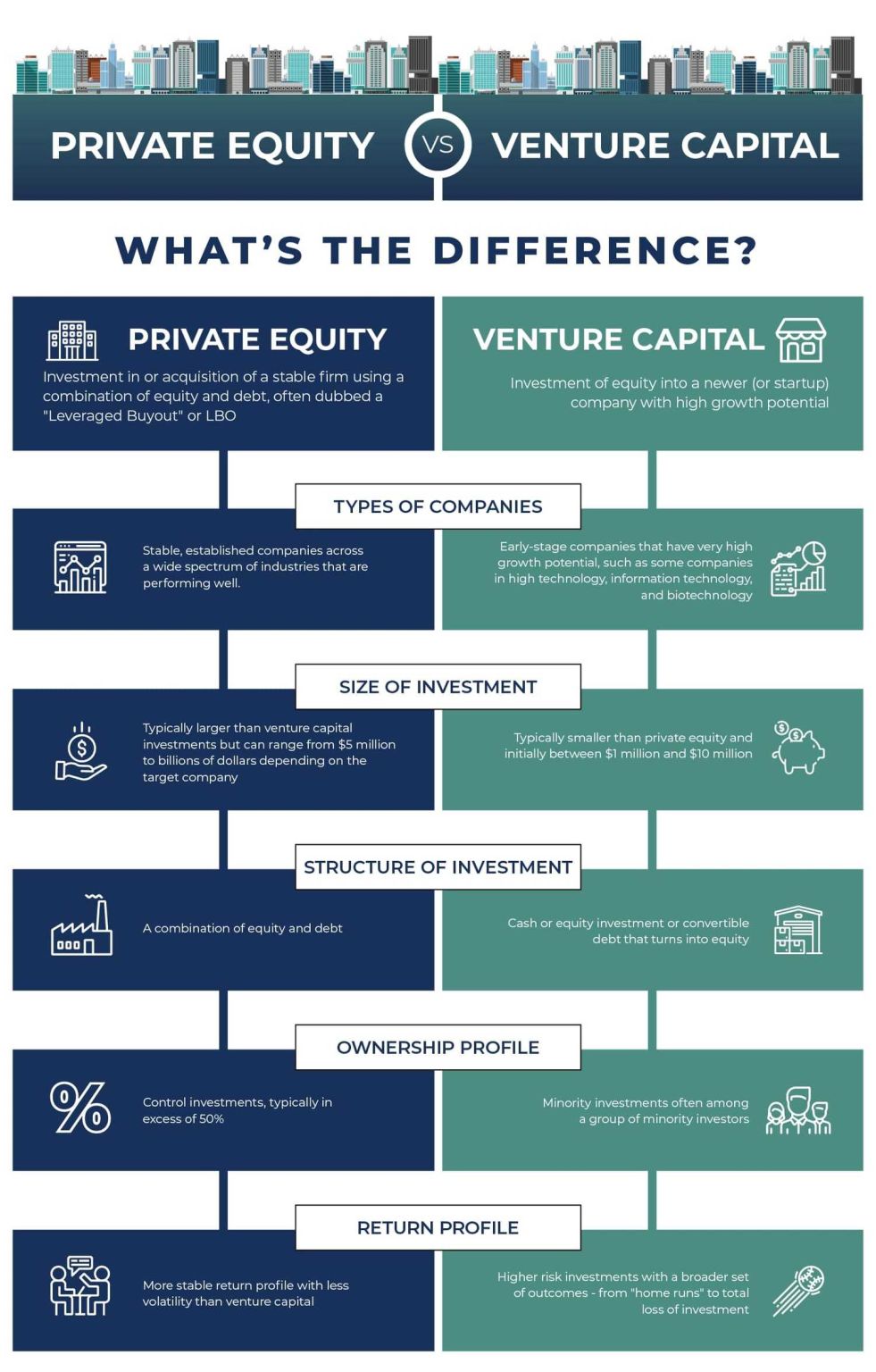

Patrick Roberts, JD from HedgeStone Business Advisors (insights) & Clay Brock from Hadley Capital (image below).

Patrick elaborates… Venture Capital (VC) and Private Equity (PE) represent separate forms of investment within the private market. Although both involve investing in privately-held companies, they target different stages of a company’s lifecycle and exhibit unique characteristics.

1️⃣ Investment Stage: VC: 💡 Invests in early-stage, high-potential startups with disruptive ideas and potential for exponential growth. PE: 📊 Targets mature companies with established revenue streams and profits, aiming to optimize operations and financial performance.

2️⃣ Risk Profile: VC: ⚠️ Higher risk due to the uncertain nature of startups; many fail to achieve growth objectives. PE: 🛡️ Lower risk, as mature companies exhibit more stability, which can be enhanced through operational improvements and financial engineering.

3️⃣ Investment Size: VC: 💰 Smaller investments, typically ranging from thousands to millions of dollars, depending on the funding round and startup’s valuation. PE: 🏦 Larger investments, often in the range of hundreds of millions to billions of dollars, to acquire controlling stakes in companies.

4️⃣ Industry Focus: VC: 🚀 Primarily targets high-growth technology, biotechnology, and innovative consumer products sectors. PE: 🌐 Broad industry exposure, including manufacturing, retail, services, and technology sectors, among others.

5️⃣ Investment Structure: VC: 📈 Acquires minority stakes in startups, providing capital in exchange for equity shares. PE: 🏢 Typically acquires majority or controlling stakes in companies, often through leveraged buyouts (LBOs), using a combination of equity and debt.

6️⃣ Exit Strategies: VC: 🎉 Aims for successful exits via Initial Public Offerings (IPOs) or acquisitions by larger companies, usually within 5-10 years. PE: 🔁 Exits often involve selling the company to another PE firm, conducting an IPO, or via strategic acquisitions, typically within 3-7 years.

7️⃣ Value Creation:

VC: 💼 Provides capital, strategic guidance, and access to networks to accelerate growth and scale-up operations.

PE: ⚙️ Focuses on improving operational efficiencies, financial management, and corporate governance to enhance the overall performance and value of the company.

So there you have it. Venture capital and private equity are two distinct investment strategies 🎯 with different risk profiles, target companies, and value creation approaches. While VC fuels innovation and growth 🌱 in startups, PE aims to optimize the performance and value 💪 of mature companies.