4 risks to retirement income

From: Allianz

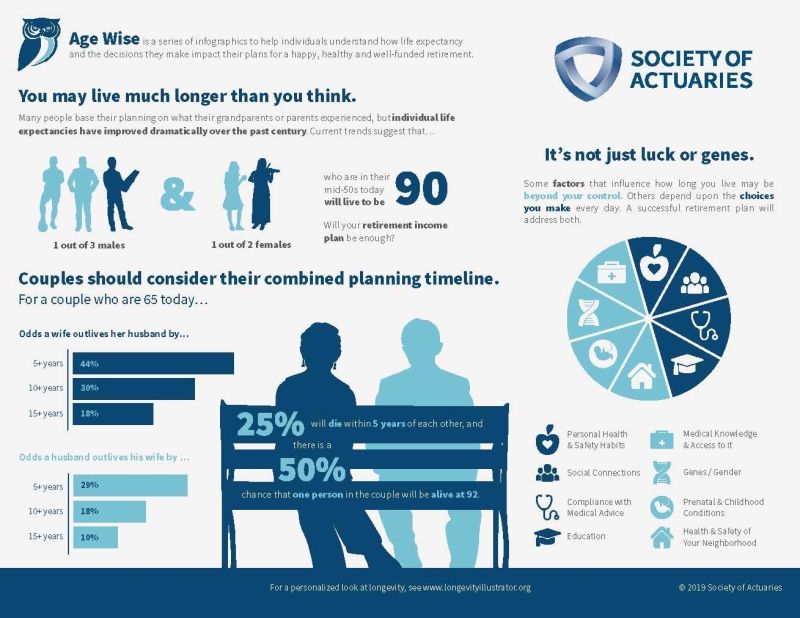

Clients in today’s economic environment need to be prepared for a variety of risks to their financial well-being. Their retirement strategy in particular needs a mix of assets that can help support and protect long-term goals.

Along with traditional sources of retirement income – including Social Security benefits, a 401(k), an annuity, and other investments – a fixed index universal life insurance (FIUL) policy can play an important…