Watch one independent financial advisor talk about being a fiduciary and how she serves clients.

Miscellaneous

Institutional Investors vs. Retail Investors: What’s the Difference?

Institutional Investors vs. Retail Investors: What’s the Difference?

From: www.investopedia.com

Institutional vs. Retail Investors: An Overview

Investing attracts different kinds of investors for different reasons. The two major types of investors are the institutional investor and the retail investor.

An institutional investor is a company or organization with employees who invest on behalf of others (typically, other companies and organizations). The manner in which an institutional investor allocates capital that’s to be invested…

Institutional vs. Retail Investors: Differences and FAQs

Institutional vs. Retail Investors: Differences and FAQs

From: www.indeed.com

Institutional and retail investors have many similarities in their roles. Aside from those commonalities, there are numerous areas of distinction between them. If you’re interested in a career in finance, understanding the differences between institutional and retail investors can help you choose the right investing career for you. In this article, we define institutional and retail investors, examine the key differences between them…

Justice Department Issues Web Accessibility Guidance Under the Americans with Disabilities Act

Justice Department Issues Web Accessibility Guidance Under the Americans with Disabilities Act

From: www.justice.gov

The Department of Justice published guidance today on web accessibility and the Americans with Disabilities Act (ADA). It explains how state and local governments (entities covered by ADA Title II) and businesses open to the public (entities covered by ADA Title III) can make sure their websites are accessible to people with disabilities in line with the…

Surviving Spouses May Not Be Responsible for Partners’ Medical Bills

Surviving Spouses May Not Be Responsible for Partners’ Medical Bills

From: www.nytimes.com

A call from a debt collector may add to the challenges that bereaved people are already dealing with. But spouses “should not assume that they have to pay.”

The death of a spouse can be devastating, and in the aftermath, calls from collection agencies about medical bills and other debts could not come at a worse time.

But surviving spouses may…

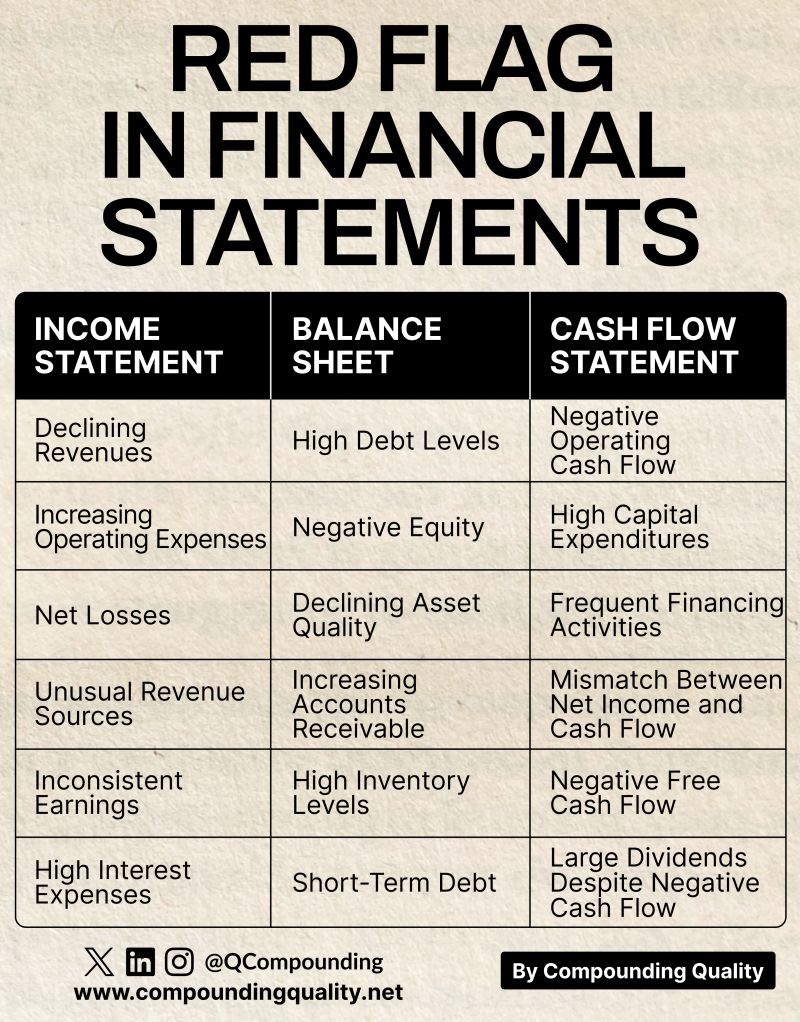

Red Flags in Financial Statements

Red Flags in Financial Statements

From: www.linkedin.com (Pieter Slegers)

Noticing red flags will make you a better investor

The pdf includes:

• Declining Revenues

• Increasing Operating Expenses

• Net Losses

• Unusual Revenue Sources

• Inconsistent Earnings

• High Debt Levels

• And much more!

The Financial Statements…explained on ONE page

The Financial Statements…explained on ONE page

From: www.linkedin.com (Josh Aharonoff, CPA)

It doesn’t matter what industry you are in…

EVERYONE should understand how to read financial statements

When you understand Financial Statements you…

✅ Understand more about business

✅ Can perform your job in Finance & Accounting better

✅ Can build a robust forecast

and so much more

Let’s do a deep dive on how they work

➡️ The Profit & Loss (also known as Income Statement)

This statement is…

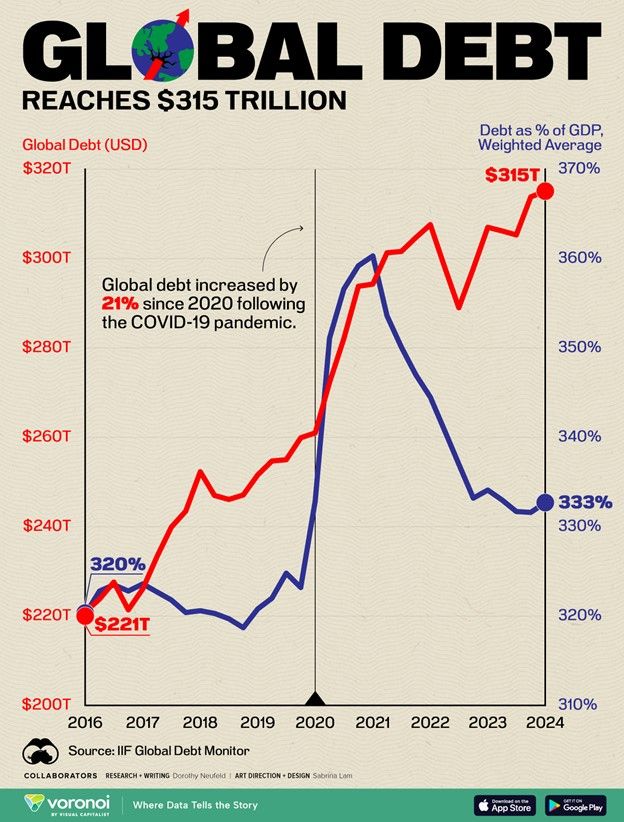

Global Debt Reaches $315 Trillion

Global Debt Reaches $315 Trillion

From: www.linkedin.com

Global debt is at $315 trillion, up 21% since COVID-19.

The Downside of Falling Interest Rates

The Downside of Falling Interest Rates

From: www.nytimes.com

With the Federal Reserve expected to cut short-term interest rates later this month, investors face some tricky choices.

While falling rates are usually viewed as a boon for the stock market, that’s not the case for all parts of the investment universe. In fact, for money you may need soon, where safety is a major priority, falling interest rates aren’t great news at all.

Whenever…

Inheriting a Home With Your Siblings? Here’s All That Can Go Wrong

Inheriting a Home With Your Siblings? Here’s All That Can Go Wrong

From: www.realtor.com

If you and your siblings are on track to one day inherit your parents’ home, take heed of this cautionary tale.

In a Reddit thread AmITheA—le, a poster recounts how when his mom died in 2018, she left him and his two siblings her house.

“My siblings wanted to sell the house and split the money,”…