Get your taxes ready early and right

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

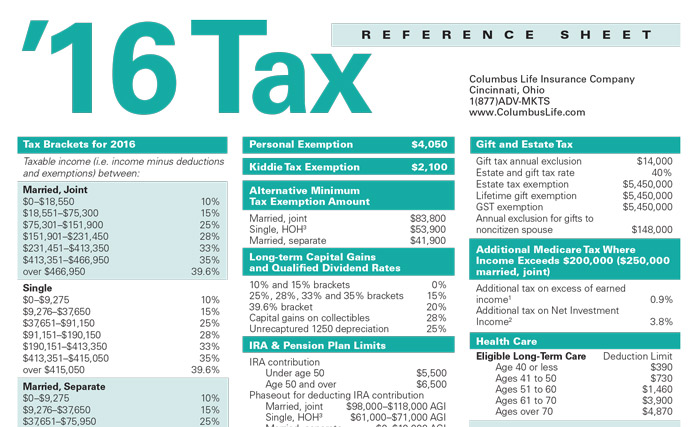

Although the tax deadline is still a few months away, it’s a good idea to gather all relevant documents well in advance of the tax prep rush of early spring. Now is the time to review and organize your annual financial milestones to help ensure a smooth experience.

Review the basics.

A lot can…