Your Year-Round Tax Planning Check-Up

From: www.marinerwealthadvisors.com

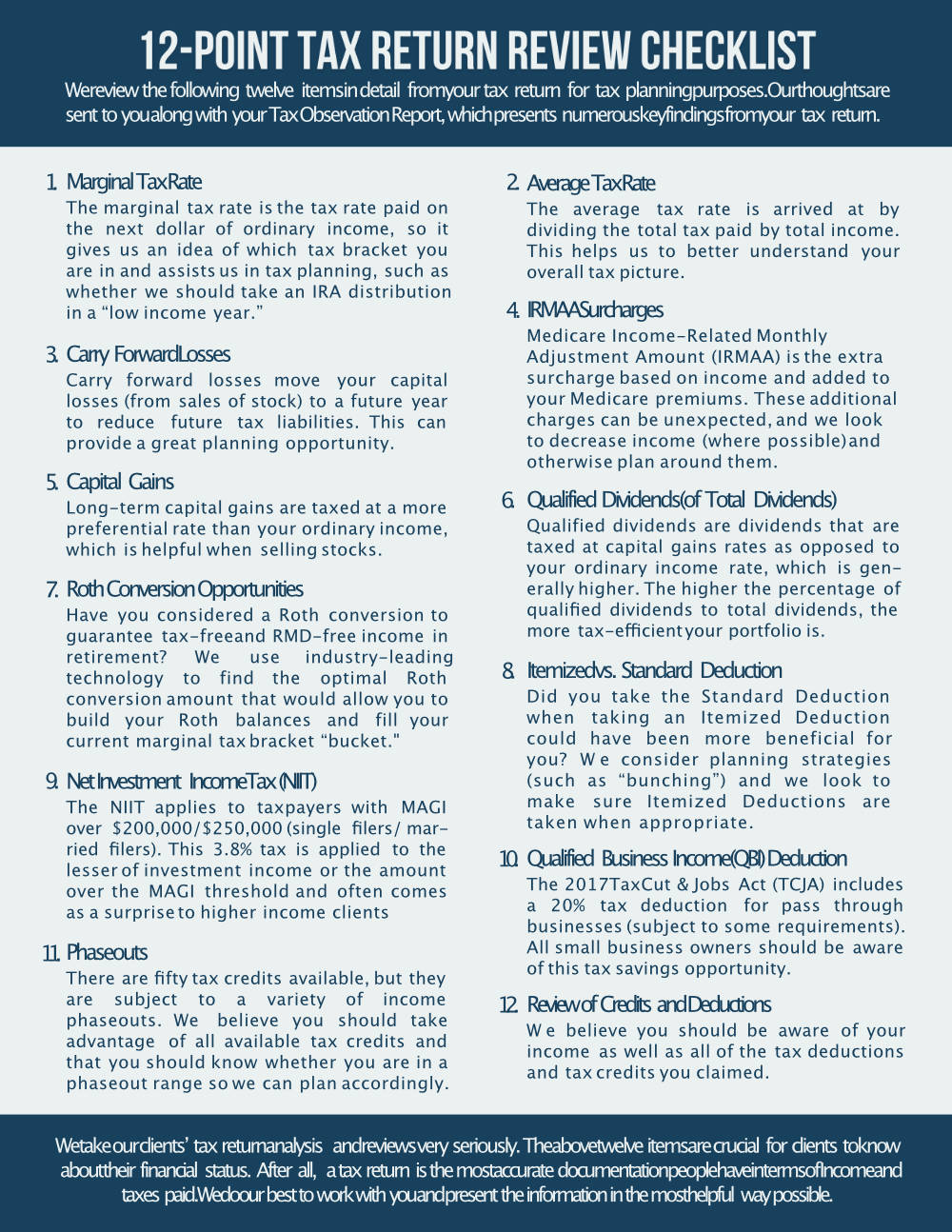

Keep your tax planning on track

Tax planning isn’t just a springtime activity. Just like going to the doctor for annual check-ups is a crucial part of maintaining your health, so too are annual check-ups for your tax planning. Your needs evolve from year to year, so the following checkpoints can help you ensure your tax planning stays on track.