Reports

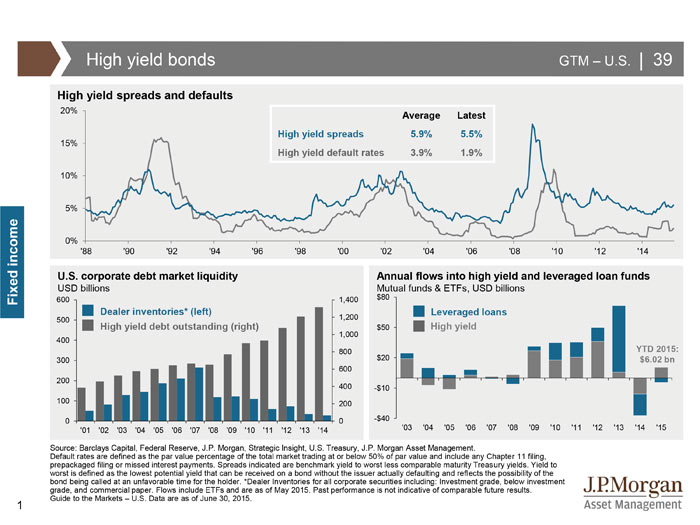

High yield bonds

JP Morgan Q3 Guide to the Markets

JP Morgan Q3 Guide to the Markets

From: jpmorganfunds.com

Tax Year 2014 Form 5498s Are Now Available

From Ameritrade:

5498 Forms for Tax Year 2014 will be mailed no later than June 1, 2015. Copies of these forms are now available on Veo®.

To view them, go to Accounts > Consolidated View > Documents, then Tax Forms > 5498.

Form 5498 reports all individual contributions and rollover contributions to all IRAs (including SEP and SIMPLE IRAs). It also reports employer contributions and rollovers deposited into SEP and SIMPLE IRAs.

Evidence-Based Investing

Evidence-Based Investing

A Scientific Framework for the Art of Investing

Science has produced many tremendous advances, from lifesaving medical treatments to instantaneous communication. Historically, though, science has had little influence on investing. Instead of keeping pace with advancements in modern portfolio theory and historical and statistical evidence, investors and money managers often rely on conventional wisdom and flawed assumptions. How can investors…

Science has produced many tremendous advances, from lifesaving medical treatments to instantaneous communication. Historically, though, science has had little influence on investing. Instead of keeping pace with advancements in modern portfolio theory and historical and statistical evidence, investors and money managers often rely on conventional wisdom and flawed assumptions. How can investors…

U.S. Index Dashboard March 2015

Large-cap U.S. equities encountered significant turbulence in the first quarter. The S&P 500 ended the quarter up 1%, while the Dow Jones Industrial Average was relatively flat.

Unlike their large-cap counterparts, mid- and small-cap equities enjoyed a strong quarter. The S&P MidCap 400 and the S&P SmallCap 600 ended the quarter up 5% and 4%, respectively.

Growth outperformed value, as the S&P 500 Growth gained 2%, while the S&P 500 Value declined 1%.

Following…

Canada Index Dashboard March 2015

Canadian equities ended the first quarter of 2015 in the black, with the S&P/TSX Composite and the S&P/TSX 60 gaining 3% and 2%, respectively.

The strongest performing sector of the S&P/TSX Composite was Health Care by a wide margin (45%). Energy was the weakest performer, down 1%.

Large-cap U.S. equities encountered significant turbulence in the first quarter. The S&P 500® ended the quarter up 1%, while the Dow Jones Industrial Average was relatively flat.

Dow Jones Q1 2015 Report Card

At A Glance

At Quarter End – The Dow Jones Industrial Average ended Q1 2015 at 17,776.12 – down 46.95 points or – 0.26 % from the close of 20 14 . In comparison, the DJIA’s average Q1 return over the prior 30 years is 3.18%.

Leader & Laggard – Boeing Co. (BA) contributed the most to the Average’s advance; American Express (AXP) was the leading detractor.

Industry Performance – Consumer Services was the best performing industry,…

Asset Based vs. Traditional LTC

Asset Based vs. Traditional LTC:

| Traditional | Asset Based |

| Payment option (Pay premiums for life) | Premiums can be lifetime/continuous pay or can be limited to a certain number of years – single pay, 10 pay, etc. |

| Initially the premium is less expensive than asset based LTC insurance | Initially the premium is more expensive than traditional LTC insurance |

| Limited benefits | Benefits can be for the lifetime of the insured |

| Written only on individual lives | Written on individual or joint lives |