Reports

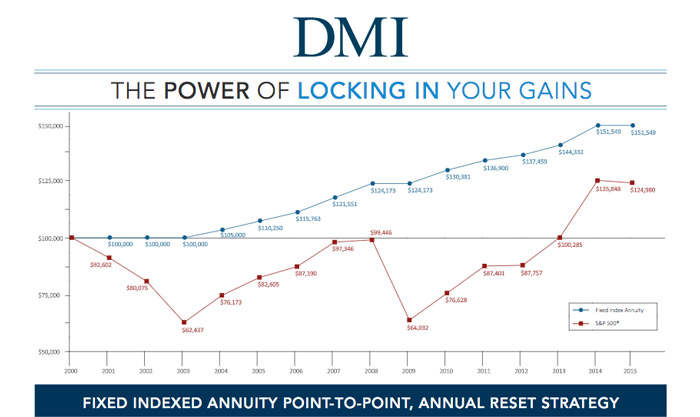

The Power of Locking in Your Gains

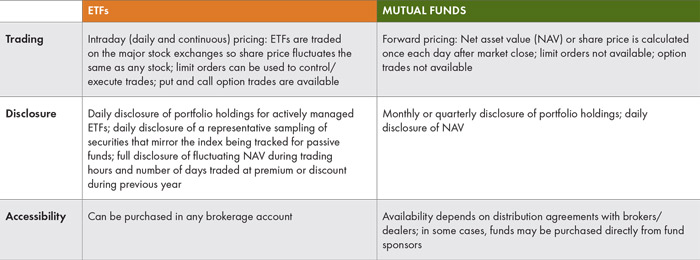

ETF vs Mutual Funds

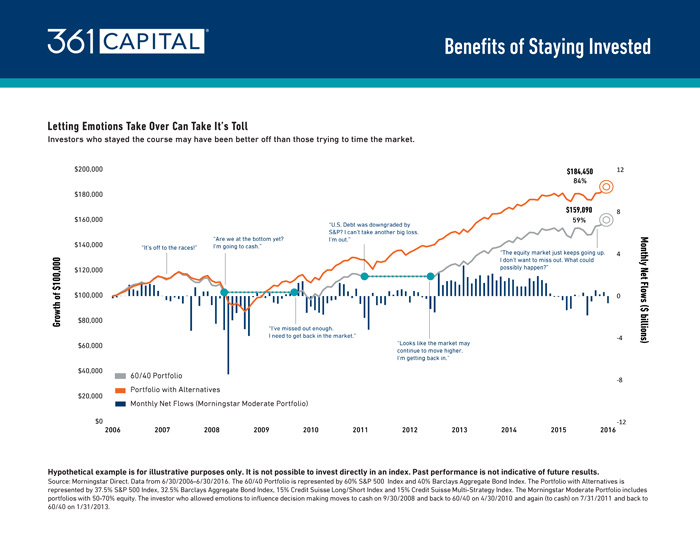

Market Timing Costs Investors Big: Dalbar

Market Timing Costs Investors Big: Dalbar

From: thinkadvisor.com

Dalbar’s annual study of investor behavior shows that self-directed investors work against themselves largely by chasing the market.

Investors are their own worst enemy, or so is the conclusion of Dalbar’s 22nd annual Quantitative Analysis of Investor Behavior study that compared equity fund returns of directed investments versus the market benchmark. This year’s study found that in 2015, investors returns came in at -2.28% for…

Benefits of Staying Invested

Downside protection when investors need it the most

Seeking diversification to help mitigate the effect of volatility on their portfolios, investors often consider REITs, commodities, and hedge funds, but overlook high-quality bonds, which just might be the Rodney Dangerfields of the investment world. They don’t get any respect.

This chart demonstrates various investments’ track records during turbulent periods for equity markets. By sorting monthly equity returns into deciles and examining the worst periods, we find that high-quality bonds have proved to be one…

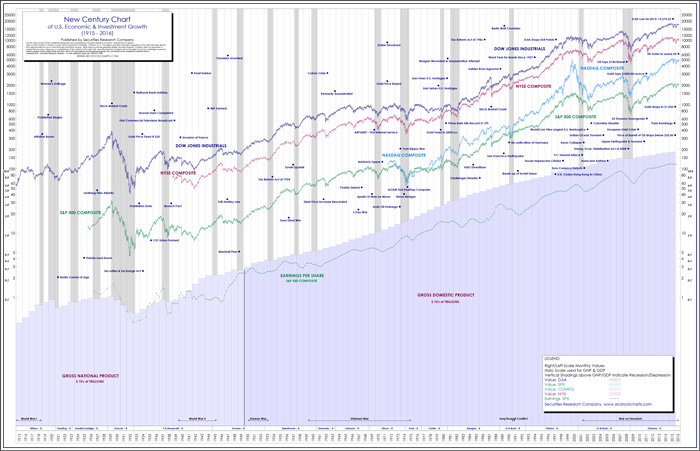

U.S. Economic & Investment Growth (1915 – 2016)

WFP Income Fund Announces a 7.52% Net Annualized Return through 1st Quarter 2016

WFP Income Fund Announces a 7.52% Net Annualized Return through 1st Quarter 2016

From: wilshirefp.com

The WFP Income Fund, managed by Wilshire Finance Partners, paid investors a 7.52% net annualized non-compounded return through the first quarter of 2016. The net annualized compounded return for the first quarter of 2016 was 7.56%. The net annualized compounded return for the fund since its inception on September 23, 2013 through March 31, 2016 was 8.65%.

The…

Municipal Bonds Outpacing Stocks And May Offer Attractive Tax-Equivalent Yields

Municipal Bonds Outpacing Stocks And May Offer Attractive Tax-Equivalent Yields

From: Sierra Mutual Funds & Ocean Park Asset Management, Inc.

Municipal bonds (“munis”) have a lot of attractive qualities. First and foremost, unlike Treasuries or corporate bonds, the interest paid on municipal bonds is free from federal and, in some cases, state and local income taxes. That may make munis especially appealing to investors in higher personal income tax brackets. Check out the chart…

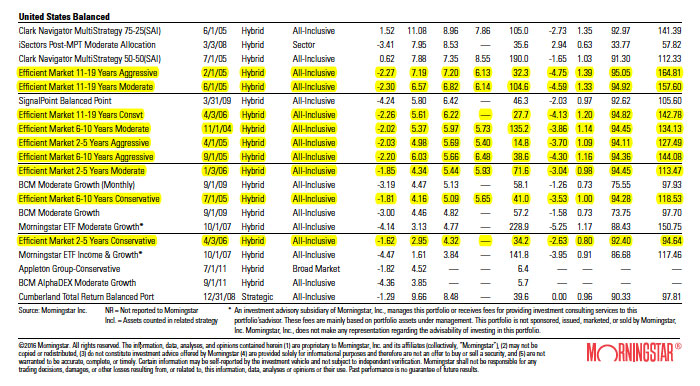

Morningstar 2015 Q4 Report

Key Takeaways

- Morningstar is tracking 755 strategies from 154 firms with total assets of $73 billion through December 2015.

- Total assets in these strategies tracked by Morningstar fell 3% in the fourth quarter of 2015.

- Global All-Asset strategies retain the top position, collectively accounting for 30% of the universe.

- 2015 was a challenging year for most managers, as they struggled to stand out in a market that…