“This chart shows historical performance of the S&P 500 index throughout the U.S. Bull and Bear Markets from 1926 through 2016. Although past performance is no guarantee of future results, we believe looking at the history of the market’s expansions and recessions helps to gain a fresh perspective on the benefits of investing for the long-term.”

Reports

Economic Update – August 14th, 2017

August 14th, 2017 – Economic Update

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

TAME INFLATION PERSISTS

Can the Federal Reserve justify another interest rate hike in the second half of 2017? Given weak inflation pressure, maybe not. The central bank has set a 2% yearly inflation target, but the Consumer Price Index rose only 0.1% in July, resulting in a 1.7% year-over-year gain. Core consumer prices rose 0.1%…

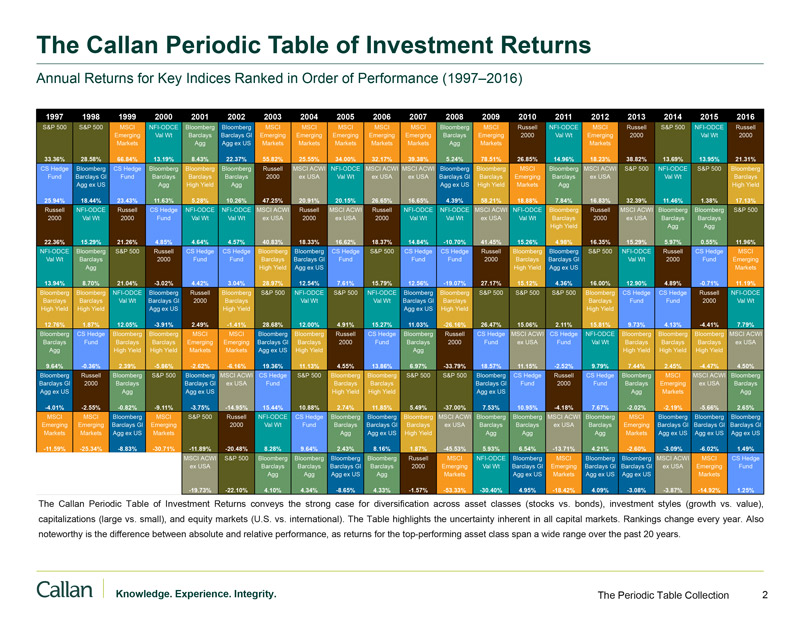

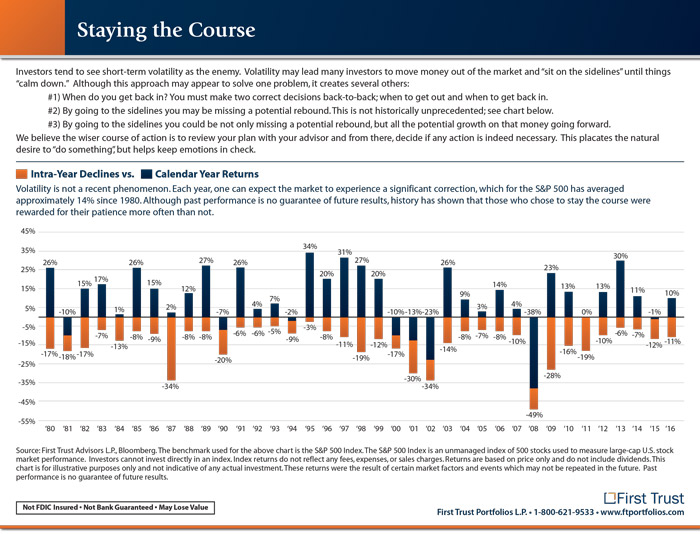

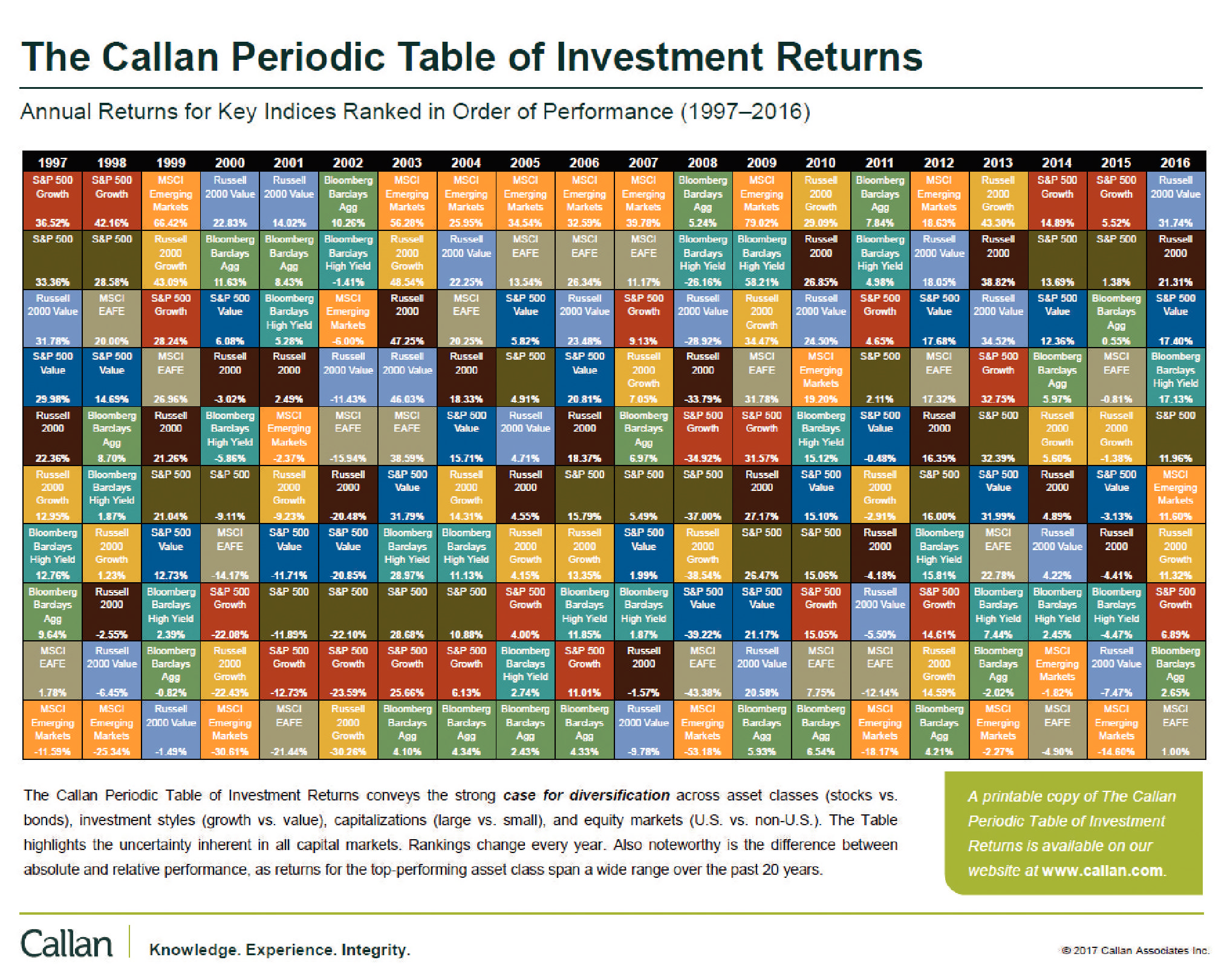

Callan Periodic Table of Investment Returns

The Value of an Objective Opinion

The Value of an Objective Opinion

The Importance of Timing

Although genetics can play into one’s life expectancy, a survey by the Society of Actuaries showed that there is a disconnection between how long people expect to live and the age their oldest family members reached. Despite half of retirees and pre-retirees reporting that they had a family member who lived longer than 90 years, both groups expected to live an average of six years less…

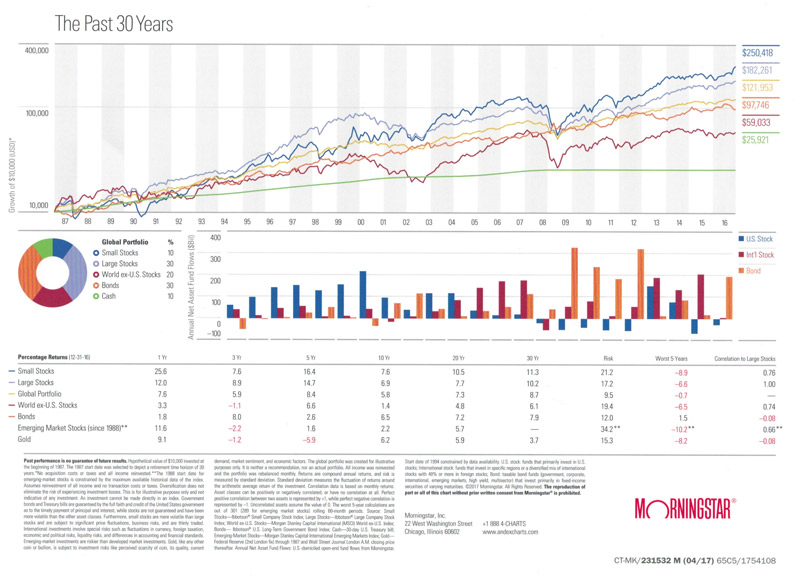

Morningstar 2017 Andex Chart

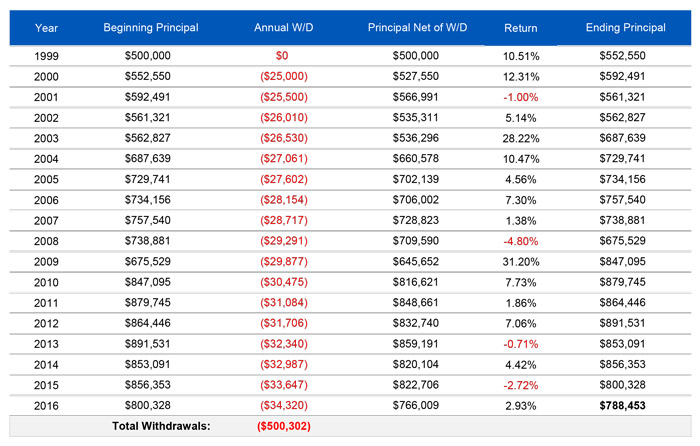

Income / Withdrawal Needs

One of the greatest challenges to retirement income is retiring at a market top. The following illustrations show the differences in three portfolios starting at the market top of 1999. It can be difficult to create an income stream in today’s interest rate environment with traditional income sources. These illustrations compare two portfolio’s vs. our Balanced Risk Program that can provide clients with income.

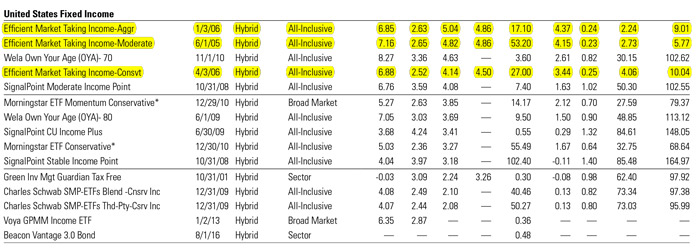

Morningstar 2016 Q4 Report

Key Takeaways

- Morningstar was tracking 881 strategies from 162 firms with total assets of $86.7 billion through December 2016.

- Total assets in these strategies as reported to Morningstar increased 2.2% in the fourth quarter of 2016.

- This marks the fourth consecutive quarter of growth in this space. Approximately $95 million of the $1.9 billion in quarter-over-quarter growth was driven by the addition of new strategies to…

White Paper: An In-Depth Look at Defined Maturity ETFs

White Paper: An In-Depth Look at Defined Maturity ETFs

From: Guggenheim Investments

As the ETF market has evolved, so too has the depth and breadth of available products.

Defined maturity exchange traded funds (ETFs), a recent structural innovation in the rapidly growing ETF market, have created a wide range of new opportunities for fixed income investors. Today, these ETFs provide sectorspecific exposure to fixed income markets, including segments of the market previously only accessible…