Investment/Asset Allocation

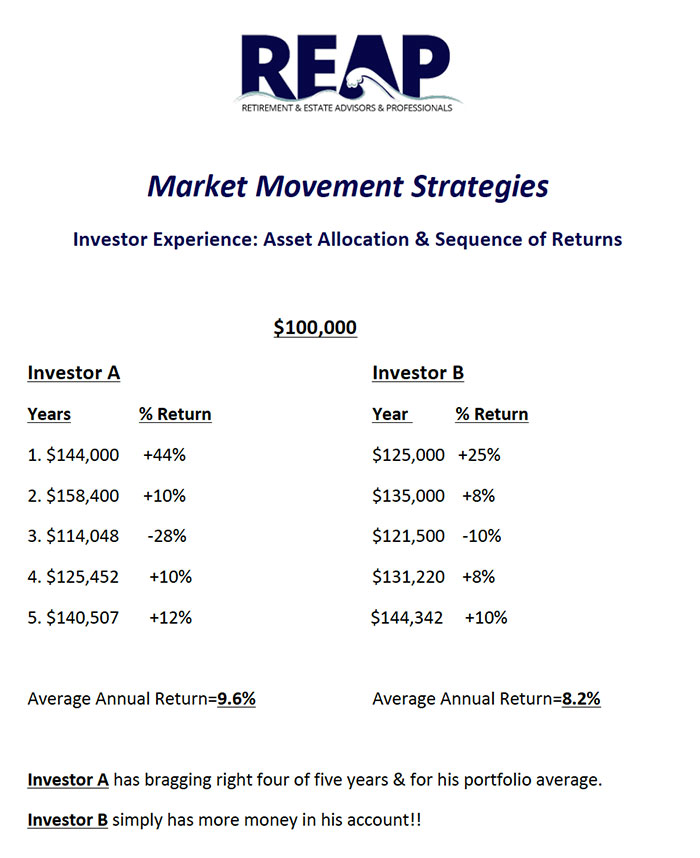

Market Movement Strategies

Change Your Investment Goal

Change Your Investment Goal

From: huffingtonpost.com

For approximately 85 percent of individual investors, their investment goal is to “beat the market.” If you are one of those investors, I want you to consider abandoning that goal and making a new one. Instead, try capturing market returns for the asset classes in which you invest.

Poor historical returns

By some estimates, over the 20 years from Dec. 31, 1993 to Dec. 31, 2013, the average investor…

Market Movement Investment Management

“Alpha and beta separation is the new investment foundation, and traditional managers have been at the losing end.” -Patrick Quirk, Pension and Investments Magazine

An informative presentation by FTJ FundChoice, LLC, discusses the impact of market movement on investor behavior, evolution in diversification, multi-strategist portfolio process, and much more.

The S&P 500 Shouldn’t Be The Barometer Of Investor Success, Here’s Why

The S&P 500 Shouldn’t Be The Barometer Of Investor Success, Here’s Why

From: forbes.com

Far too often, individual investors measure the success of their investment portfolios, or the effectiveness of their financial advisors, relative to the performance of a well-known stock market index such as the S&P 500 Index or the Dow Jones Industrial Average Index.

While it is important for investors to have a tool to measure the success of an investment strategy…

When underperforming the S&P 500 is a good thing

When underperforming the S&P 500 is a good thing

From: investmentnews.com

Matching the index last year would have involved too much risk.

As financial advisers roll through annual client reviews, many will face the task of having to explain how their portfolio strategies so badly lagged the 13.7% gain by the S&P 500 Index last year.

Fact is, a truly diversified investment portfolio should have returned less than 5% in 2014. It was that kind…

Managed-volatility funds have yet to be tested

Managed-volatility funds have yet to be tested

From: marketwatch.com

You won’t find out if your roof is leaking on a sunny day; it takes a storm to see where the problems are.

In the mutual fund world, the last five years of sunny returns and limited volatility have meant that the nascent class of assets known as “managed-volatility funds” has been able to function as a shelter without much of a test on…

TD Ameritrade Year End Notice

To all our clients,

We’d like to make you aware of several approaching year-end activities with potential tax implications for 2014, and the dates by which action must be taken in order for TD Ameritrade Institutional to meet the December 31 deadline.

• Deadline for Required Minimum Distributions (RMDs): Clients who are 70½ or older must take an RMD from their IRA and/or their QRP for the 2014 tax year. All RMDs must be withdrawn…

TKA Stop Loss Models Bond/Cash Question

Quick disclaimer and one piece of long term historical context:

1) Disclaimer: The Barclays Aggregate Bond index started in 1976. Prior to 1976, almost all bond issuance (other than commercial paper) was 20 – 30 year tied to depreciation schedules. Therefore, we can’t tell what AGG would have since the duration is a fraction of the long bond in those periods. But with bond math, we do know the draws would…

If Index Funds Perform Better, Why Are Actively Managed Funds More Popular?

If Index Funds Perform Better, Why Are Actively Managed Funds More Popular?

From: Wharton University of Pennsylvania

It’s been nearly 35 years since the precursor to The Vanguard Group, now the country’s largest mutual fund company, offered the first index-style mutual fund to individual investors. Through mutual funds and exchange-traded funds, indexing now accounts for about $1.6 trillion in investor assets, and indexing has legions of diehard believers.

A parade of studies has shown…