Blog & Helpful Articles

How do you plan to spend your bonus?

Go to page: How do you plan to spend your bonus?

Go to page: How do you plan to spend your bonus?

How do you plan to spend your bonus?

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

Whether it’s tied to performance, holiday profits or a tax refund, nothing beats the joy of receiving a bonus. But resist the temptation to blow it all on something that could be short-lived. Instead, consider the following, all of which can have a lasting impact.

- Pay down debt. If you’re carrying a credit…

Market Timing Costs Investors Big: Dalbar

Market Timing Costs Investors Big: Dalbar

From: thinkadvisor.com

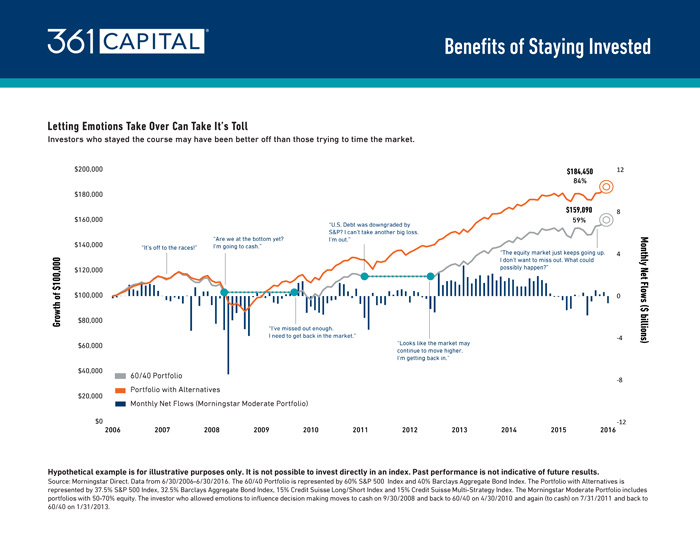

Dalbar’s annual study of investor behavior shows that self-directed investors work against themselves largely by chasing the market.

Investors are their own worst enemy, or so is the conclusion of Dalbar’s 22nd annual Quantitative Analysis of Investor Behavior study that compared equity fund returns of directed investments versus the market benchmark. This year’s study found that in 2015, investors returns came in at -2.28% for…

Trumpeting 10 Year-End Tax Strategies Before They Evaporate

Trumpeting 10 Year-End Tax Strategies Before They Evaporate

From: wealthmanagement.com

In light of Donald Trump’s election and his pre-election platform to reduce marginal income tax rates, there are several planning strategies that should be considered as part of your client’s year-end planning. John O. McManus, founding principal of McManus & Associates, provides his top 10 actions for you to advise your client to take now.

Benefits of Staying Invested

Donald Trump’s Death Tax Proposal – A Non-Partisan View

Donald Trump’s Death Tax Proposal – A Non-Partisan View

From: stites.com

As this time, it is difficult to determine what the specific provisions of President-Elect Donald J. Trump’s tax proposals will be; however, it is important to highlight the types of planning that are not likely to be affected, and therefore could, and should, continue.

First, in 2016, federal estate and gift taxes became an issue for estates (including life insurance that isn’t…

3 Tips for Minimizing Financial Anxiety

Go to page: 3 Tips for Minimizing Financial Anxiety

Go to page: 3 Tips for Minimizing Financial Anxiety

3 Tips for Minimizing Financial Anxiety

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

When unexpected or worrisome financial news hits, what do you do? Constantly checking your portfolio can derail you from long-term goals, while having zero awareness of your finances can lead to reckless overspending or other bad behavior.

Information travels faster than ever these days, and it’s easy for investors to feel alarmed or panicked about…

The next 4 years are going to be more difficult for investors

The next 4 years are going to be more difficult for investors

From: marketwatch.com

A bear market will still come, and you are still responsible for saving enough for retirement

America voted for change on Tuesday. Whether you celebrate that result or dread it, don’t react by making significant changes to your investment portfolio.

Yes, the immediate aftermath of the election is greater market volatility, but that was obvious hours before the election results…

Downside protection when investors need it the most

Seeking diversification to help mitigate the effect of volatility on their portfolios, investors often consider REITs, commodities, and hedge funds, but overlook high-quality bonds, which just might be the Rodney Dangerfields of the investment world. They don’t get any respect.

This chart demonstrates various investments’ track records during turbulent periods for equity markets. By sorting monthly equity returns into deciles and examining the worst periods, we find that high-quality bonds have proved to be one…

College Rankings That Measure More Than Academics

Go to page: College Rankings That Measure More Than Academics

Go to page: College Rankings That Measure More Than Academics

College Rankings That Measure More Than Academics

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

With higher education costs escalating faster than traditional inflation, it’s important to treat the college selection process as the serious investment it is. Whether you, your child, grandchild or other loved one is researching colleges and universities, calculating the actual value of higher education can help whittle down the options and justify the escalating…