Blog & Helpful Articles

Active and Passive Cycles: Better Together

Top 10 Estate Planning Tax Facts for 2019

Top 10 Estate Planning Tax Facts for 2019

From: www.thinkadvisor.com

Although every client should review his or her estate planning strategy on a fairly regular basis, after a major tax overhaul, it’s important for clients to take an even more detailed look at the various elements of their estate plans.For some clients, this will require evaluating changing circumstances and future goals to determine whether existing trusts and other planning strategies…

Maintain Good Credit With These 3 Tips

Go to page: Maintain Good Credit With These 3 Tips

Go to page: Maintain Good Credit With These 3 Tips

Maintain Good Credit With These 3 Tips

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

You’ve worked hard to earn a high credit score — now what?

To stay in good standing and keep your borrowing rates as low as possible, some vigilance is required. Smart consumers know they should keep an eye on their excellent credit to make sure it stays that way.

This doesn’t demand much effort, either. Are you taking…

U.S. Supreme Court Ruling Regarding Inherited IRAs Highlights the Benefits of IRA Trusts

U.S. Supreme Court Ruling Regarding Inherited IRAs Highlights the Benefits of IRA Trusts

From: www.thewealthadvisor.com

Earlier this month, the US Supreme Court released an opinion holding that funds held in inherited IRAs are not “retirement funds” for bankruptcy purposes. In Clark v. Rameker, the Court based this finding strongly on the fact that “nherited IRAs do not operate like ordinary IRAs.”

The Clarks, during their bankruptcy proceeding, argued that an inherited…

Retirement Planning: Solving for the Major Risks in Retirement

Retirement Planning: Solving for the Major Risks in Retirement

Whitepaper from REAP Strategist, Horizon Investments

ABSTRACT

Generating income throughout retirement is increasingly the focus of financial advisors and institutions. The shift in focus is due to an aging population and a three-decade-long bull market for bonds that is expected to end. This paper examines different potential asset allocation strategies in the context of retirement spending. Specifically, we want to understand how longevity risk (outliving…

Maximum Drawdown: A New Approach to Managing Investment Risk

Maximum Drawdown: A New Approach to Managing Investment Risk

Whitepaper from REAP Strategist, Horizon Investments

Ever since Modern Portfolio Theory (MPT) was introduced in 1952, the answer to the question of how investment risk should be measured and managed has largely been codified as volatility or standard deviation. MPT is a framework that, in theory, allows an investor to maximize return for a given level of risk, defined in the MPT framework as…

Redefining Risk: The Revolution Coming to Financial Services

Redefining Risk: The Revolution Coming to Financial Services

Whitepaper from REAP Strategist, Horizon Investments

EXECUTIVE SUMMARY

As a goals-based investment manager, we believe investment problems and challenges are best addressed in the context of an investor’s goals—the purpose behind their investment programs. By aligning investment solutions with investor goals, investors have a better opportunity to measure the actual “real world” outcomes they seek. Each investment-related goal consists of three stages—accumulation (or the Gain…

Slow Down The Aging Process And Enjoy Your Retirement

Go to page: Slow Down The Aging Process And Enjoy Your Retirement

Go to page: Slow Down The Aging Process And Enjoy Your Retirement

By Jennifer Frost

The way that we age is only 20% down to genetics. The other 80% is down to how healthy we are and the lifestyle that we lead. If you retire at 60, you may have several decades to enjoy and it is important to spend this time well. You might be slowing down in terms of your working life, but to slow down the aging process, you…

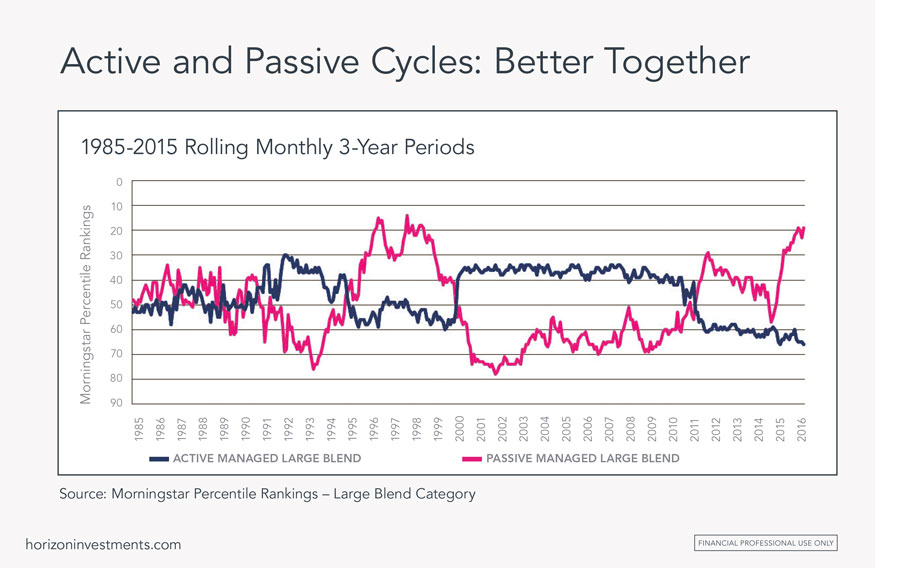

Actively vs. Passively Managed Funds Performance

Actively vs. Passively Managed Funds Performance

From: www.morningstar.com

4 key takeaways from Morningstar’s U.S. Active/Passive Barometer

The Morningstar Active/Passive Barometer is a semiannual report that measures the performance of actively versus passively managed funds within their respective Morningstar Categories. The barometer is unique in the way it measures active managers’ success relative to the actual, net-of-fee performance of passive funds rather than an index, which isn’t investable.

We…