Blog & Helpful Articles

What to Know About Passive Income

Go to page: What to Know About Passive Income

Go to page: What to Know About Passive Income

What to Know About Passive Income

From: REAP, LLC. | Retirement & Estate Advisors & Professionals

If you’re looking to boost your earnings, build your legacy or want a complement to your long-term savings, building passive income might be a goal to consider.

An extra source of income can make retirement a little sweeter, and it may also help you get to the point of retirement a few years or months earlier.

Want to know…

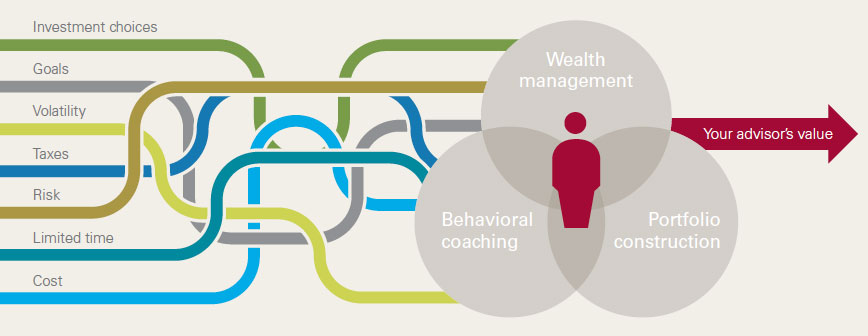

Bringing value through advice

Bringing value through advice

From: Vanguard

Your investment goals are personal

They’re about taking care of your family, feeling secure, and being comfortable. And whether your goals include retirement planning, charitable giving, or transitioning wealth, selecting a professional advisor to help you is a critical decision for your financial future. You want to make sure you’re getting real value. But how do you define the value of advice?

Putting a value on your value

Putting a value on your value

From: Vanguard

- The value proposition of advice is changing. The nature of what investors expect from advisors is changing. And fortunately, the resources available to advisors are evolving as well.

- In creating the Vanguard Advisor’s Alpha concept in 2001, we outlined how advisors could add value, or alpha, through relationship-oriented services such as providing cogent wealth management via financial planning, discipline, and guidance, rather than by trying to outperform…

10 Benefits of Working with a Financial Advisor 2020

10 Benefits of Working with a Financial Advisor

From: Orion

1. Financial Health Assessment

We tend to be biased when evaluating our finances. A financial advisor will assess your current financial health from an objective standpoint.

2. Tailored Goal Formation

From professional and personal to health and familial, setting goals is a daunting task. The right financial advisor will help you draw a financial thread through your ambitions and set appropriate, realistic, and manageable fiscal goals…

The True Value of Financial Advice

The True Value of Financial Advice

From: Horizon Investments

Have you been to a financial services conference lately? Then you know that the tectonic force shaking our industry is technology.

Except, that’s not entirely true.

The landscape is changed. And technology is being increasingly used in ever more sophisticated ways. But the real seismic shift shaking the ground beneath our feet isn’t digital transformation — it’s the Copernican Revolution.

It’s a radical change in…

What Is the Difference Between Qualified Dividends and Ordinary Dividends?

What Is the Difference Between Qualified Dividends and Ordinary Dividends?

From: www.fool.com

Qualified dividend tax rates and ordinary dividend tax rates are two different categories. Here’s how to know if your dividends qualify for the lowest tax rates and what it could mean to your wallet.

When you receive a dividend payment from an investment, it will fall into one of two categories for tax purposes: qualified or ordinary. The tax…

Keeping The Motor Running: Choosing The Right Car For Retirement

Go to page: Keeping The Motor Running: Choosing The Right Car For Retirement

Go to page: Keeping The Motor Running: Choosing The Right Car For Retirement

By Jennifer Frost

With Americans spending on average just under 11 hours per week in their car, you would be wise to consider whether your current car is as ready for retirement as you might be. Whether or not you choose to keep a car will, of course, depend largely on how much you are able to access your friends, family, leisure activities and day to day life without one. Maintaining…

Afraid to Retire? What to Do on Day One

Afraid to Retire? What to Do on Day One

From: nextavenue.org

How the 3 C’s can ease your way into a fulfilling retirement

You’re standing alone on the edge of a cliff, staring off into a vast unknown. Is this you, thinking about retirement?

Or as one man told me during my research into the new retirement: “So I wake up in the morning, go to the fitness club and have…

Drafting Income Tax-Sensitive Trusts

Drafting Income Tax-Sensitive Trusts

From: Blase & Associates, LLC

The disparate federal income tax treatment between trusts and individuals, that has existed since 1986, has grown even more pronounced than it was prior to the passage of the 2017 and 2019 year-end tax laws. This article will examine the problems which currently face us and will propose solutions to these problems.

Part I: Impact of the 2017 Year-End Tax Changes

As a result of the…