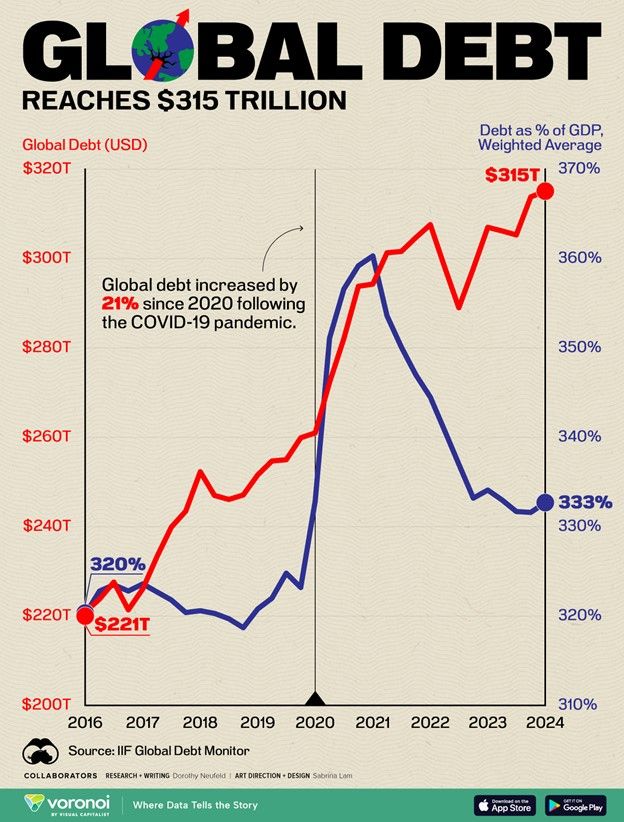

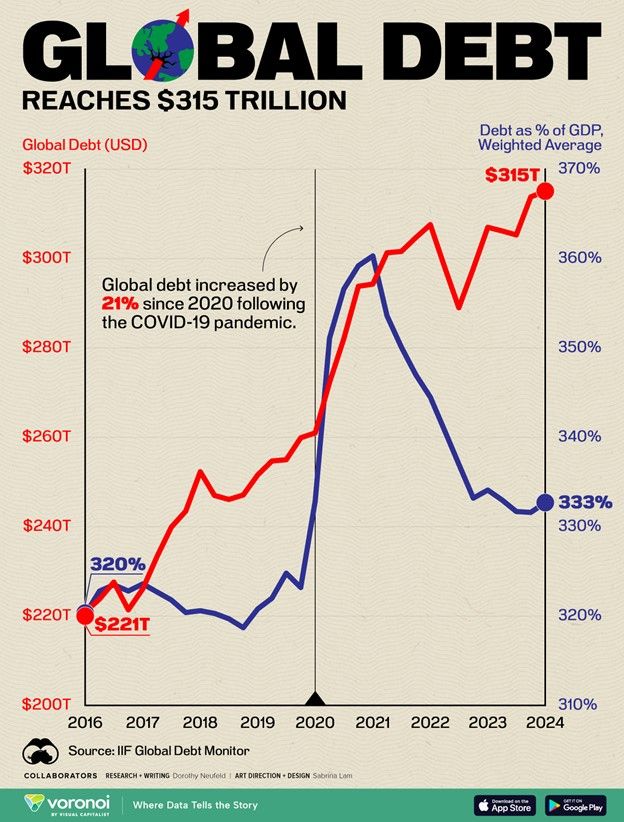

Global Debt Reaches $315 Trillion

From: www.linkedin.com

Global debt is at $315 trillion, up 21% since COVID-19.

From: www.linkedin.com

Global debt is at $315 trillion, up 21% since COVID-19.

From: www.nytimes.com

With the Federal Reserve expected to cut short-term interest rates later this month, investors face some tricky choices.

While falling rates are usually viewed as a boon for the stock market, that’s not the case for all parts of the investment universe. In fact, for money you may need soon, where safety is a major priority, falling interest rates aren’t great news at all.

Whenever…

From: www.realtor.com

If you and your siblings are on track to one day inherit your parents’ home, take heed of this cautionary tale.

In a Reddit thread AmITheA—le, a poster recounts how when his mom died in 2018, she left him and his two siblings her house.

“My siblings wanted to sell the house and split the money,”…

From: www.schwab.com

A Roth IRA conversion involves moving assets from other retirement plans into your Roth IRA. Learn how to convert a Roth IRA and whether it’s right for you.

Does it ever make sense to pay taxes on retirement savings sooner rather than later? When it comes to a Roth individual retirement account (IRA), the answer could be yes. A Roth IRA is…

From: www.einpresswire.com

JACKSONVILLE, FLORIDA, UNITED STATES

The Fiduciary Advisor Network proudly announces the addition of a distinguished new advisor, David Morgan, of The R.E.A.P. Companies. This partnership not only strengthens the network’s capacity of esteemed advisors, but also promises significant benefits for the Jacksonville community.

From: linkedin.com

11.6% per year over the past 40 years — you’re free to have your own feelings about investing in the stock market, but you can’t have your own facts.

This 40 year period has included recessions, wars, Y2K, 9/11, the tech bubble, the real estate meltdown, political turmoil, etc.

When you stay scared and keep your money uninvested, you miss out on a…

By David H. Morgan

From talk given at Ormond Beach Presbyterian Church

We are living in turbulent times. Al around us in the past year we have witnessed a myriad of storms:

1. Natural Ones: such as many hurricanes, earthquakes, forest fires, and other sorts of weather extremes. Just this morning, and many times recently, there remain more and more articles about rising seas nationally, continued turbulence in the oceans and the Gulf of Mexico, and local…

From: wharton.upenn.edu

Wharton’s Olivia S. Mitchell states the stark truth about saving: “Let’s be honest, saving is no fun. People don’t get ‘utils’ (or utility) out of saving. They get utils out of spending. Therefore we must devise new ways to make saving more enjoyable.”

Retirees can get those utils if their savings, including pensions or annuities, are sufficient to finance their lifestyle…

U.S. large cap stocks, as measured by the S&P 500, delivered a solid performance in the first half of 2024. In January, the index eclipsed an all-time high, and in the five months that followed, it reached 31 more. Volatility has also been relatively subdued. In the first six months, there was only one instance when the index rose or fell by more than 2%…

By David H. Morgan

From talk given at Ormond Beach Presbyterian Church

The A, B, C’s and D of Stewardship

What is stewardship and what does it mean to you, to me, and OBPC?

I think they can be best explained by the A, B, C, and D’s of giving:

I. My Personal History: Left Atlanta in 2003-04, searched for a church home for 3, 4 years. I opted to finally decide on OBPC for a myriad of reasons,…

Copyright © 2025 • REAP | Retirement & Estate Advisors & Professionals • All rights reserved