Watch one independent financial advisor talk about being a fiduciary and how she serves clients.

Archive for Developer

A Discussion of the Value Financial Advisors Bring to the Wealth Management Process

A Discussion of the Value Financial Advisors Bring to the Wealth Management Process

Learn how advisors can enhance an investor’s life by helping improve their decision-making process, and how working with an advisor may increase an investor’s sense of confidence and security.

Research has found investors who purchase financial advice are more than one and one half times more likely to stick with their long-term investment plan than those who did not. Because of this commitment…

The True Value of Working with a Financial Advisor

The True Value of Working with a Financial Advisor

When you consider the benefits of working with a financial advisor, don’t simply begin and end with investment returns. Good financial advisors will do more than manage your portfolio—they’ll manage the journey you take to reach your goals by:

1. Answering Your Questions

Just like you would consult a doctor with medical questions, your financial advisor will be there to answer any questions you have regarding…

Institutional Investors vs. Retail Investors: What’s the Difference?

Institutional Investors vs. Retail Investors: What’s the Difference?

From: www.investopedia.com

Institutional vs. Retail Investors: An Overview

Investing attracts different kinds of investors for different reasons. The two major types of investors are the institutional investor and the retail investor.

An institutional investor is a company or organization with employees who invest on behalf of others (typically, other companies and organizations). The manner in which an institutional investor allocates capital that’s to be invested…

Institutional vs. Retail Investors: Differences and FAQs

Institutional vs. Retail Investors: Differences and FAQs

From: www.indeed.com

Institutional and retail investors have many similarities in their roles. Aside from those commonalities, there are numerous areas of distinction between them. If you’re interested in a career in finance, understanding the differences between institutional and retail investors can help you choose the right investing career for you. In this article, we define institutional and retail investors, examine the key differences between them…

Why Roth Conversions Are Not A One-Size-Fits-All Solution

Why Roth Conversions Are Not A One-Size-Fits-All Solution

From: www.fa-mag.com

Any client who hopes to maximize their retirement funds, you would be wise to explore Roth IRAs. Converting to a Roth IRA is an increasingly popular retirement strategy, but bear in mind it certainly isn’t a one-size-fits-all solution.

Potential Benefits Of Roth Conversions

Clients can transfer their funds from a traditional IRA or 401(k) into a Roth IRA through a

Justice Department Issues Web Accessibility Guidance Under the Americans with Disabilities Act

Justice Department Issues Web Accessibility Guidance Under the Americans with Disabilities Act

From: www.justice.gov

The Department of Justice published guidance today on web accessibility and the Americans with Disabilities Act (ADA). It explains how state and local governments (entities covered by ADA Title II) and businesses open to the public (entities covered by ADA Title III) can make sure their websites are accessible to people with disabilities in line with the…

Surviving Spouses May Not Be Responsible for Partners’ Medical Bills

Surviving Spouses May Not Be Responsible for Partners’ Medical Bills

From: www.nytimes.com

A call from a debt collector may add to the challenges that bereaved people are already dealing with. But spouses “should not assume that they have to pay.”

The death of a spouse can be devastating, and in the aftermath, calls from collection agencies about medical bills and other debts could not come at a worse time.

But surviving spouses may…

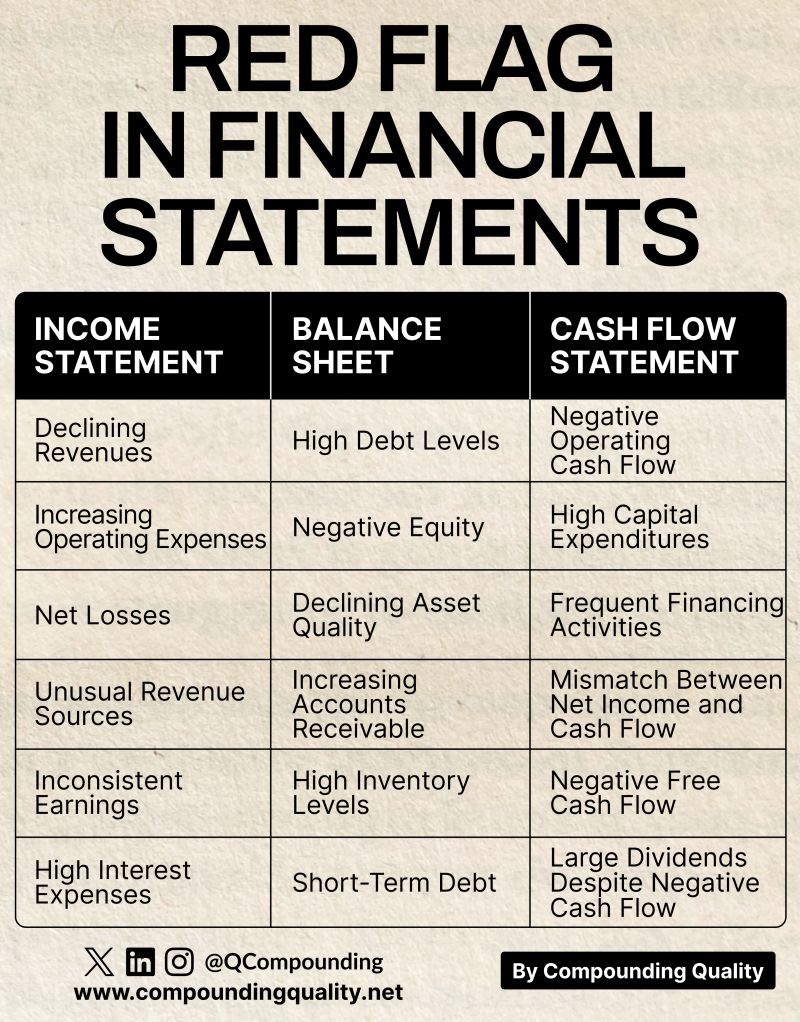

Red Flags in Financial Statements

Red Flags in Financial Statements

From: www.linkedin.com (Pieter Slegers)

Noticing red flags will make you a better investor

The pdf includes:

• Declining Revenues

• Increasing Operating Expenses

• Net Losses

• Unusual Revenue Sources

• Inconsistent Earnings

• High Debt Levels

• And much more!

How Does A Life Estate Work In Georgia?

Let’s look at the advantages and disadvantages of a life estate deed in Georgia.

Benefits Of A Life Estate Deed

A Georgia Life Estate Deed offers several benefits.

Here are some of the key advantages:

-Retain control and use of the property: The life tenant can continue to live on, use, and enjoy the property for the rest of their life, while still maintaining control over its management and maintenance.

-Bypass probate: One of the main benefits of a…