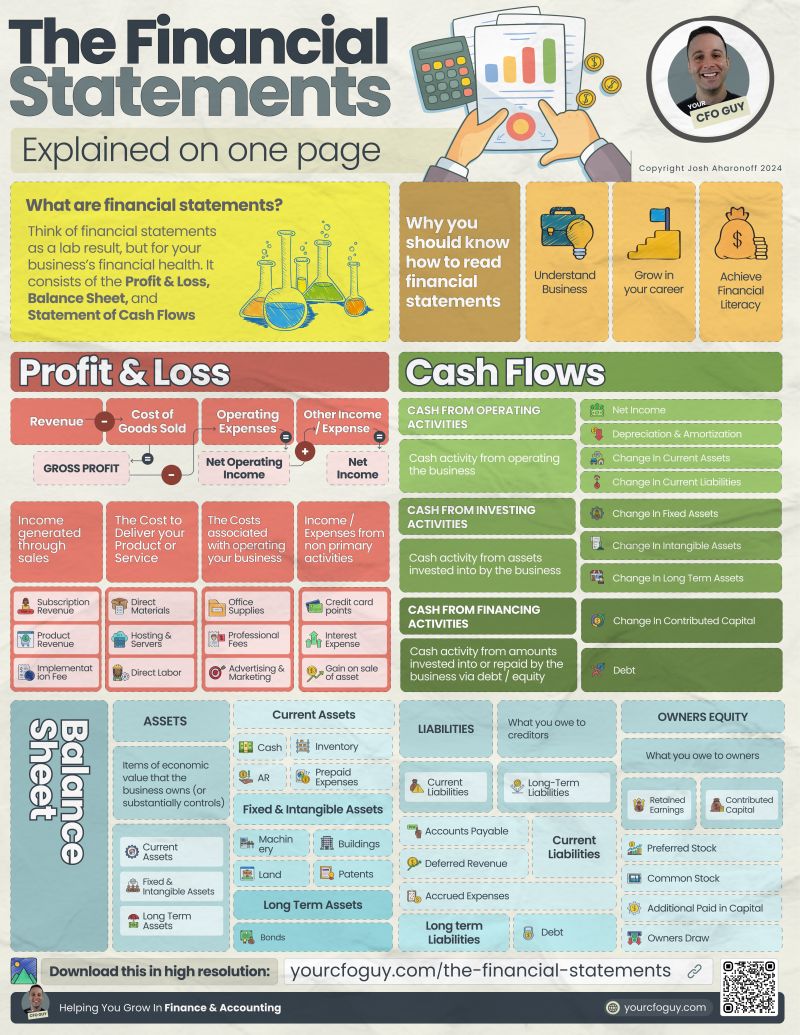

The Financial Statements…explained on ONE page

From: www.linkedin.com (Josh Aharonoff, CPA)

It doesn’t matter what industry you are in…

EVERYONE should understand how to read financial statements

When you understand Financial Statements you…

✅ Understand more about business

✅ Can perform your job in Finance & Accounting better

✅ Can build a robust forecast

and so much more

Let’s do a deep dive on how they work

➡️ The Profit & Loss (also known as Income Statement)

This statement is all about telling you about the PERFORMANCE of your company…IE your income, and your costs

Your income is summarized by

1️⃣ Revenue → income related to your core business

2️⃣ Other Income → income related to none core activities (like credit card points)

Your expenses are summarized by:

1️⃣ Cost of Goods Sold → Costs that relate to carrying out your product or service

2️⃣ Operating Expenses → Costs that relate to operating your business

3️⃣ Other Expense → Costs that don’t relate to carrying out your income, or operating your business

From these you get a bunch of profitability metrics such as Gross Profit (Revenue-COGS), Net Operating Income (Gross Profit – Opex), and net income (all income – all expenses

➡️ The Balance Sheet

This statement tells you all about the financial POSITION of your company

it is summarized by:

1️⃣ Assets → Amounts of Economic value that business owns, or substantially controls

2️⃣ Liabilities → Amounts that you owe to creditors

3️⃣ Owners Equity → Amounts that you owe to the owners

The Balance sheet is presented on a cumulative basis, which is the only statement of the 3 that acts this way

➡️ The Statement of Cash Flows

This statement is all about telling you where your cash is going

it is separated by:

1️⃣ Cash from Operating activities → this section relates to cash movements from operating your business

2️⃣ Cash from Investing activities → cash movements from fixed & long term assets (IE, Assets that are invested for long term benefit)

3️⃣ Cash from Financing activities → cash movements from amounts invested by owners, or creditors – both for amounts put in, and amounts repaid

===

I’ve done my best to include everything you need to know about how to read Financial Statements in the graphic below…

but there’s so much more to say.

What would you add?