What’s the Best-Performing Asset Type During a Recession?

From: www.morningstar.com

While bonds disappointed as diversifiers in 2022, they’ve historically performed well during economic downturns.

The Federal Reserve’s campaign to stamp out inflation by lifting interest rates caused pain for both stocks and bonds last year, prompting correlations between the two assets to increase sharply. But surging interest rates have given rise to another worry: Could the Fed overshoot on interest rates, pushing the economy into a recession along the way?

The bond market has been flashing warning signals on that front since July 2022, as yields on longer-term bonds dropped below those of shorter-term bonds. That pattern of long-term bonds paying lower rates than shorter-term bonds, called a yield-curve “inversion,” has historically been a harbinger of recession. Investors are betting that yields will go lower because of economic weakness.

Not every economist is convinced that the United States will sink into a recession imminently, and even some of the economists who do expect a recession aren’t convinced it will be especially severe. Nonetheless, with recessionary storm clouds on the horizon, it is worth looking into history to examine how various asset types have behaved in periods of economic weakness and which assets have helped diversify U.S. equity exposure. History suggests that high-quality U.S. bonds have often provided ballast to U.S. equities during such periods, but there have also been recessions when both stocks and bonds performed well.

Examining Risk/Return During Recessionary Periods

To delve into what history suggests about asset-class performance in recessionary environments, we examined eight recessionary periods in U.S. history. It is worth noting that the definition of a recession varies. While “recession” is often defined as two successive quarters of negative gross domestic product growth, the National Bureau of Economic Research defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

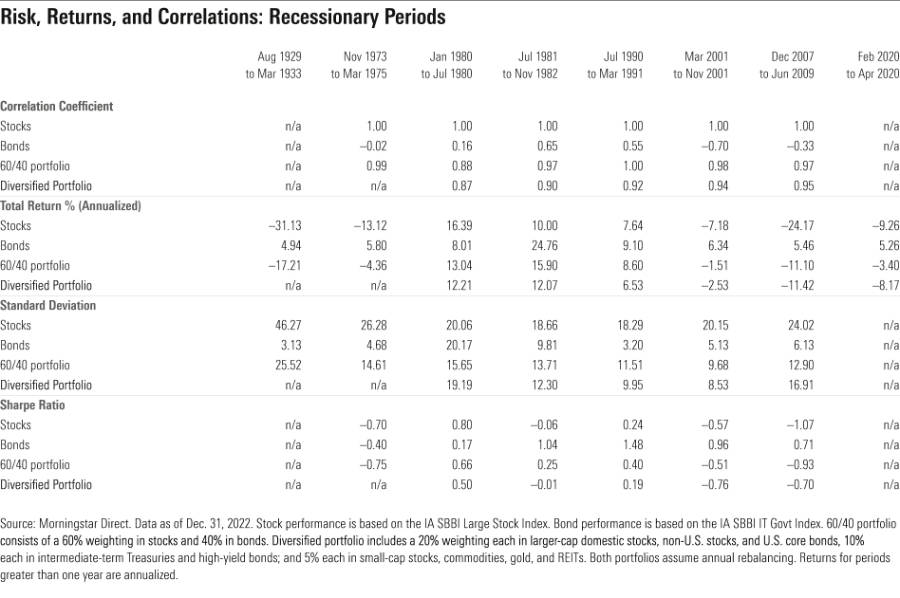

Some of the economic downturns we examined were abbreviated, such as the start of the pandemic in February/March 2020, and some were more prolonged, such as the Great Depression in the late 1920s and early 1930s. For each period, we examined the returns, volatility, and correlations of U.S. large-cap stocks, U.S. Treasury bonds, a 60/40 mix of the two assets, and a diversified portfolio encompassing U.S. and non-U.S. stocks, bonds of varying types, and small stakes in commodities, precious metals, and real estate. (The specific allocations are included in the following exhibit.)

Not surprisingly, stocks frequently contracted during past recessions, losing value in five of the eight time periods we examined. Some of those losses were severe, such as the 24% annualized loss for stocks during the global financial crisis of 2007–09. Stocks’ poor performance during such periods makes intuitive sense: Weakening economic growth translates into slackening demand and declining earnings growth for many businesses, especially those that sell discretionary goods and services.

In that same vein, bonds logged positive gains in all eight of those same periods of economic weakness. The explanation for bonds’ strength during recessionary periods is twofold. The Federal Reserve often cuts interest rates during such periods, which boosts bond prices. Moreover, investors often retreat to safety, stability, and liquidity in periods of economic insecurity (high-quality bonds and cash) and away from assets they perceive to be higher risk (equities).

The 60/40 and diversified portfolios’ returns and volatility levels, as measured by standard deviation, tended to fall between those two extremes during economic downturns. In other words, the balanced and diversified portfolios didn’t lose as much as the equity-only portfolio, nor did they fare as well as an all-government-bond portfolio would have done during those periods of economic distress. And the plain-vanilla 60% U.S. large-cap equity/40% intermediate-term government-bond portfolio tended to outperform the diversified portfolio that included exposure to high-yield bonds, smaller-cap stocks, commodities, and other asset classes.

The overarching conclusion: In an economic shock, government bonds often serve as effective ballast for equity portfolios. That’s borne out by correlation data as well. Bonds’ correlation coefficient with equities during recessionary environments ranged from strongly negative (negative 0.70 in the period from March 2001 to November 2001) to more positive (0.65 in the period from July 1981 to November 1982). Bonds therefore provide a significant diversification benefit, even during periods when stock/bond correlations are relatively high.

Examining the Outliers

Yet, as much as the data underscores the weakness of stocks and the benefits of holding a government-bond portfolio during recessionary environments, a few time periods stand out as outliers and are worthy of further examination. In three recessionary periods—January 1980–July 1980, July 1981–November 1982, and July 1990–March 1991—stocks actually gained ground, and high-quality bonds did, too. In other words, stock market losses and bond market gains aren’t a fait accompli in every recession.

It is worth homing in on the two recessions in the early 1980s—the so-called “double-dip” recession—because they have some of the closest parallels with the current time frame. The Iran-Iraq war in 1980 caused energy prices to surge and led to broad-based inflation: In 1980, the inflation rate surged to nearly 14%. The Federal Reserve, led by Paul Volcker, aggressively increased interest rates to combat soaring prices. That caused high unemployment and two economic contractions—a mild recession from January 1980 to July 1980 and a deeper one from mid-1981 to late 1982. Despite those headwinds, stocks managed to post robust gains in 1980 and 1982, contributing to positive returns in both early 1980s recessions. (Stocks did post a loss in 1981, however.) Stock market participants appeared to be looking through the bad news to better times ahead, including an end to rising inflation and interest rates, as well as a recovery in economic growth. They were also cheered by President Ronald Reagan’s tax cuts and regulatory rollbacks, among other factors.

Portfolio Implications

Of course, each time period is different, and the current economic environment is almost certainly different from that of the early 1980s. For one thing, the 2023 economy appears to be pretty resilient, even in the face of inflation and dramatic interest-rate increases, thanks largely to the health of the labor market. Yet, even as equity returns during recessions are scattershot, the data suggest that high-quality fixed-income assets are a boon to portfolios in most recessionary environments. That is largely due to lower yields and investors’ desire for the stability and safety of fixed income and cash assets during periods of economic turbulence, both of which boost bond prices. While high-quality bonds won’t diversify equities in every market environment (see: 2022), they have historically been reliable in periods of economic weakness.