Maximum Drawdown: A New Approach to Managing Investment Risk

Whitepaper from REAP Strategist, Horizon Investments

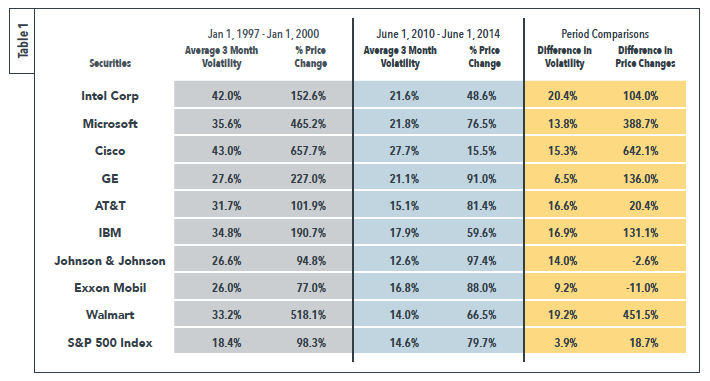

Ever since Modern Portfolio Theory (MPT) was introduced in 1952, the answer to the question of how investment risk should be measured and managed has largely been codified as volatility or standard deviation. MPT is a framework that, in theory, allows an investor to maximize return for a given level of risk, defined in the MPT framework as standard deviation of returns. But is volatility the correct metric to use when assessing investment risk for an individual? Certainly, volatility increases in strong down markets. But is volatility the culprit—or simply an innocent bystander? Consider, for example, that there can be long stretches of time during which investor outcomes are good, notwithstanding a high volatility environment, like the 3-year stretch from 1997-2000 shown in Table 1.

Table 1 examines two lengthy time periods—one in which investors saw extraordinarily strong returns with low volatility, and another characterized by extraordinarily strong returns with high volatility. This raises an important question: If an investor can achieve outstanding returns in either a high- or low-volatility environment, why should we talk about risk in volatility terms? Was it riskier to hold Walmart stock from 1997-2000 when it appreciated 518% than it was to hold it from 2010-2014 when it rose just 66.5%? If we use volatility as our risk metric, the answer is a resounding “yes”—since the volatility during the 518% appreciation period was more than twice that of the 64% appreciation period.

Most individual investors, though, would strongly disagree with that answer.

Focus on the individual

Individual investors generally understand two important concepts at a gut level:

- Investment gains are an extremely important tool in combating the risk of loss.

- >Most of us have only got “one shot”—that is, one chance to get it right. The critical issue for investors is that they arrive at their destination, and not the nature of the path that gets them there.

(This second point comes with a behavioral caveat, however: If the mental anguish investors suffer while trying to endure large investment losses becomes too great, they will just throw in the towel and sell their investments.)

These two gut-level concepts could be described more formally as 1) maximizing the exposure to the right side of a return distribution (gains) while trying to minimize exposure to the left side of the distribution (losses), with a behaviorally-informed maximum loss limit, and 2) an individual’s investment life-span is highly path-dependent.

The first concept implies that—to an investor—gains and losses should be treated differently. In other words, all volatility is not the same.

The second concept underscores why this is so: A poor investment performance path can be unrecoverable for an individual investor. Of course, this is not necessarily so for the investment performance path of a pooled vehicle such as a pension plan, which is designed ostensibly to exist forever. A pension plan has to operate for the benefit of current and future plan members—the collection of all of their individual investment paths. Managing for any single path could lead to adverse outcomes for others in the plan. Therefore, the more traditional volatility-as-risk concept could be a valid approach.

People, however, don’t exist forever. For those of us who must deal with mortality, defining and managing investment risk should take account of those aspects of our financial lives described above.

The answer: maximum drawdown

Fortunately, there is a simple, intuitive metric that can capture these aspects: Maximum Drawdown — the most an individual can lose in their account from their highest previous account value.

Unlike volatility, Maximum Drawdown distinguishes between “good” volatility (such as the late 1990s) and “bad” volatility (such as fall 2008). Unlike seeking to minimize volatility, attempting to minimize Maximum Drawdown would not have penalized an investor during some of the greatest bull markets of our lifetimes (including the mid- to late-1990s, 2013, and 2017). To the contrary, a Maximum Drawdown focus would have allowed portfolios to take advantage of the loss-buffering gains those markets offered.

A shift in thinking about an individual’s investment risk from volatility to Maximum Drawdown yields powerful insights on how to manage investment risk appropriately for individual investors. Risk management products and programs that are able to specifically target this clarifying idea of Maximum Drawdown can be better tailored to suit the needs of individual investors in ways that traditional risk management products and programs are simply unable to achieve. Maximum Drawdown-focused risk management techniques also behave in intuitive ways—doing what the investor “wants” to do, but in a controlled and methodological manner.

The upshot: Risk management techniques that approach the question of “risk” from the same standpoint taken by the clients they serve can be a great leap forward in terms of how the professional investment community manages investment risk for their individual clients.