Diversified Municipal Bond Model

By Ocean Park Asset Management

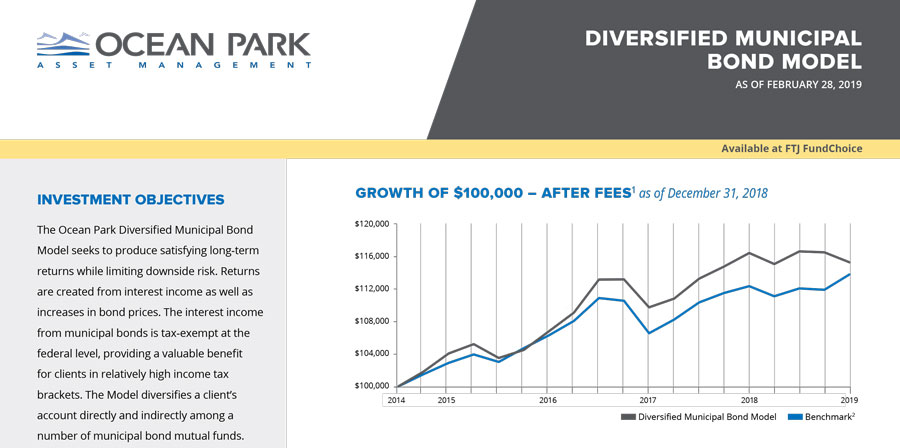

The Ocean Park Diversified Municipal Bond Model seeks to produce satisfying long-term returns while limiting downside risk. Returns are created from interest income as well as increases in bond prices. The interest income from municipal bonds is tax-exempt at the federal level, providing a valuable benefit for clients in relatively high income tax brackets. The Model diversifies a client’s account directly and indirectly among a number of municipal bond mutual funds. Trends in the municipal bond market will determine when the Model and its underlying holdings will be either fully invested or in cash. Each holding is monitored daily, and during declines a proprietary stop-loss discipline is executed with the goal of limiting drawdowns.