Five Reasons to Consider High-Yield Bonds

From: lordabbett.com

High-yield corporate bonds still present a compelling opportunity, despite tighter credit spreads.

High-yield bonds have performed very well over the past year, with the Bank of America Merrill Lynch High Yield Master II Constrained Index returning 12.65% for the 12-month period ended June 9, 2017. Although positive performance has come with tighter credit spreads, here are five reasons why we believe investors should continue to consider an allocation to below investment-grade U.S. corporate bonds.

1. Default Rates Are Low

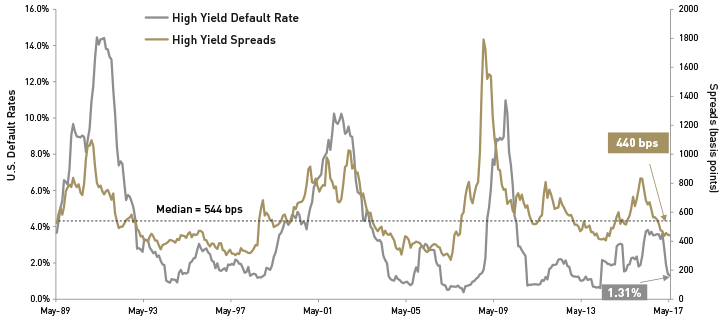

Corporate credit spreads reflect the market’s perception of and appetite for risk. From a macro perspective, widening credit spreads may be a sign of challenges for the general economy, accompanied by a “risk-off” temperament in the market. On a more micro level, a widening spread could indicate a growing concern regarding the ability of a borrower to service its debt and the possibility of default. Inversely, narrowing credit spreads may indicate a greater confidence in the ability of an issuer, or issuers in general, to make scheduled interest and principal payments.

Comparing default data to credit spreads supports this claim. High-yield spreads have narrowed considerably from their three-year month-end high, from 833 basis points (bps), on January 31, 2016, to 440 bps, on May 31, 2017.1 Meanwhile, as of May 31, 2017, the trailing 12-month default rate on the J.P. Morgan High Yield Bond Index was 1.31%. This compares with the 3.75% long-term average. Not only are default rates low today, but also Credit Suisse expects them to decline over the next 12 months.

Source: J.P. Morgan. The historical data shown are for illustrative purposes only and do not represent any specific portfolio by Lord Abbett or any particular investment. Performance quoted represents past performance. Past performance is not a reliable indicator or a guarantee of future results.

The point is, with trailing default rates well below their long-term averages and expectations that defaults will remain relatively low, it makes sense that credit spreads are lower as well.

2. Credit Quality Has Improved

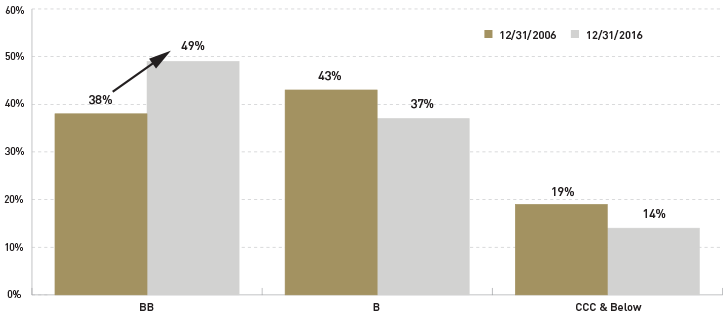

Consistent with low default rates is evidence of rising overall credit quality. Nearly 50% of the Bank of America Merrill Lynch High Yield Bond Index was rated ‘BB’ as of December 31, 2016, up from 38% 10 years ago. Naturally, as credit quality has increased, credit spreads—the compensation for credit risk—have decreased.

Source: BofA Merrill Lynch High Yield Index. The historical data shown are for illustrative purposes only and do not represent any specific portfolio by Lord Abbett or any particular investment. Performance quoted represents past performance. Past performance is not a reliable indicator or a guarantee of future results. Indexes are unmanaged and are not available for direct investment.

What is more, the use of issuance proceeds has shifted predominantly to refinancing activity. Since 2011, on average nearly 60% of proceeds have been used to pay down existing, more costly debt—typically viewed a “credit positive” trend—compared to engaging in more speculative borrowing, such as issuing debt to finance an acquisition.