Don’t Fall into the Gap

From: blackrock.com

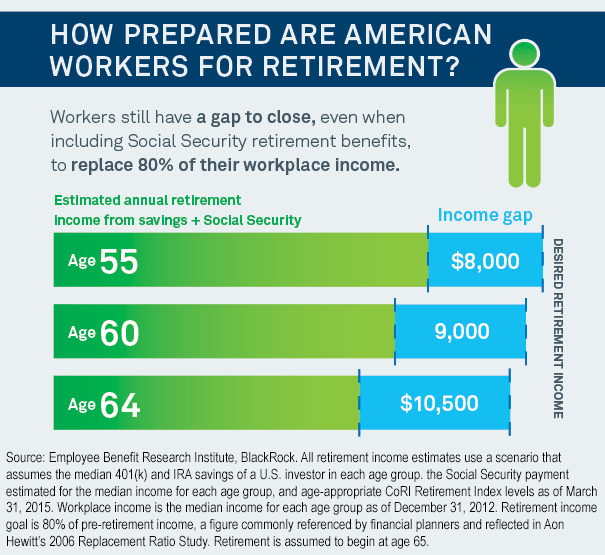

Even with 401(k) savings and Social Security retirement benefits, American workers still face an income gap in retirement.

There was a famous commercial jingle that encouraged shoppers to “Fall into the Gap,” but there’s a different kind of gap facing many retirees in retirement: an income gap. According to the first quarter CoRI™ Retirement Indexes Commentary, a 64-year-old worker with median retirement savings and median income seeking to replace 80% of his or her pre-retirement income faces an income-replacement gap of approximately 26% in retirement. Other age groups fared slightly better, but still face an income gap.

BlackRock’s analysis uses the CoRI Retirement Indexes, which are designed to measure the estimated cost of future lifetime retirement income, and also incorporates U.S. workers’ median retirement savings and income, based on research from the Employee Benefit Research Institute. In the case of the 64-year-olds, that meant median savings in both 401(k)s and IRAs of $285,009.94, as of March 31, and median annual income of $50,413.80.

Plan sponsors and their advisors can help employees assess their retirement readiness by providing access to retirement tips and tools. BlackRock’s Retirement Expense Worksheet can help savers estimate their retirement living costs, while people ages 55 to 64 can use the CoRI tool to get an idea of the income their current savings may generate in retirement. Another strategy employees may want to consider: reducing retirement living expenses. With housing costs representing a big piece of retirement expenses, workers who are open to relocating to places with a lower cost of living can reduce a big chunk of their expenses. With these tips and tools, plan sponsors and their advisors can help keep workers from falling into the (income) gap.