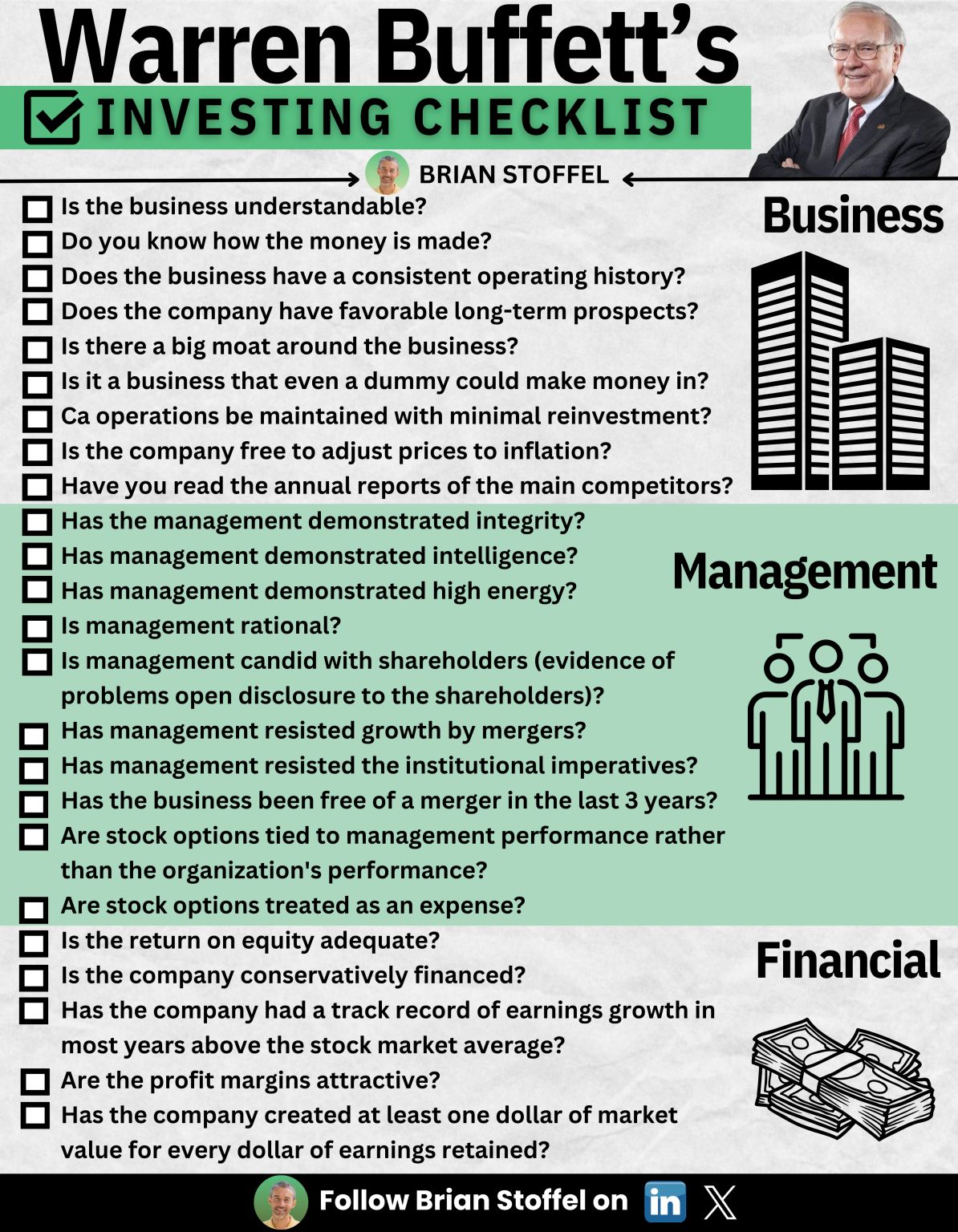

Warren Buffett’s Investing Checklist

From: www.linkedin.com (Brian Stoffel)

Warren Buffett’s Investing Checklist:

“No wise pilot, no matter how great his talent and experience, fails to use his checklist.” – Charlie Munger

🏢 BUSINESS TENETS

1: Is the business understandable?

2: Do you know how the money is made?

3: Does the business have a consistent operating history?

4: Does the company have favorable long-term prospects?

5: Is there a big moat around the business?

6: Is it a business that even a dummy could make money in?

7: Can current operations be maintained without too much reinvestment?

8: Is the company free to adjust prices to inflation?

9: Have you read the annual reports of the main competitors?

👨💼 MANAGEMENT TENETS

10: Has the management demonstrated a high degree of integrity?

11: Has the management demonstrated a high degree of intelligence?

12: Has the management demonstrated a high degree of energy?

13: Is management rational?

14: Is management candid with shareholders?

15: Has management resisted the temptation to grow quickly by merger?

16: Has management the strength not to follow the institutional imperatives?

17: Has the business been free of a major merger in the last 3 years?

18: Are stock options tied to management performance rather than the organization’s performance?

19: Are stock options treated as an expense?

💰 FINANCIAL TENETS

20: Is the return on equity adequate?

21: Is the company conservatively financed?

22: Has the company had a track record of earnings growth in most years above the stock market average?

23: Are the profit margins attractive?

24: Has the company created at least one dollar of market value for every dollar of earnings retained?

What would you add to Buffett’s excellent list?