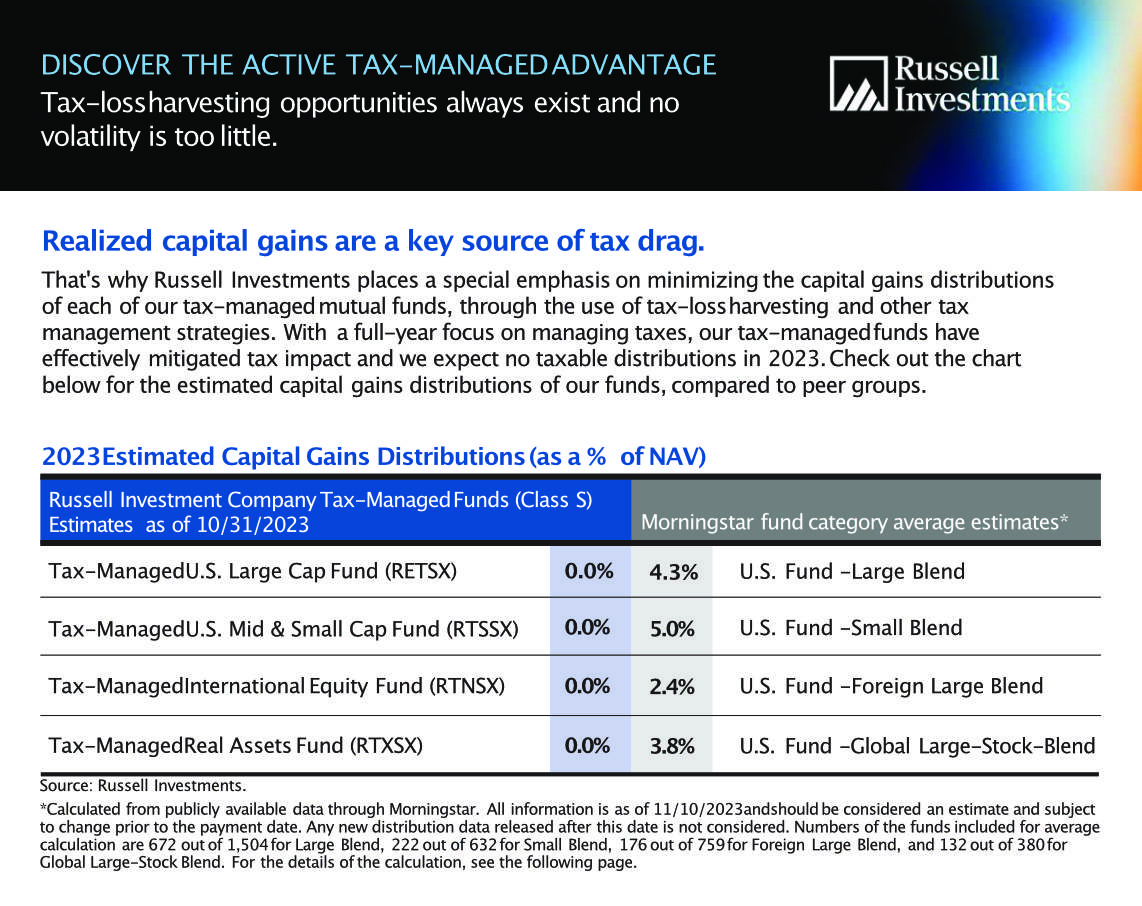

Realized capital gains are a key source of tax drag

From: Russell Investments

Tax-loss harvesting opportunities always exist and no volatility is too little.

That’s why Russell Investments places a special emphasis on minimizing the capital gains distributions of each of our tax-managed mutual funds, through the use of tax-loss harvesting and other tax management strategies. With a full-year focus on managing taxes, our tax-managed funds have effectively mitigated tax impact and we expect no taxable distributions in 2023. Check out the chart below for the estimated capital gains distributions of our funds, compared to peer groups.

For the full PDF: