How Much Loss Can Retirees Really Handle During Distribution Years?

From: www.morningstar.com

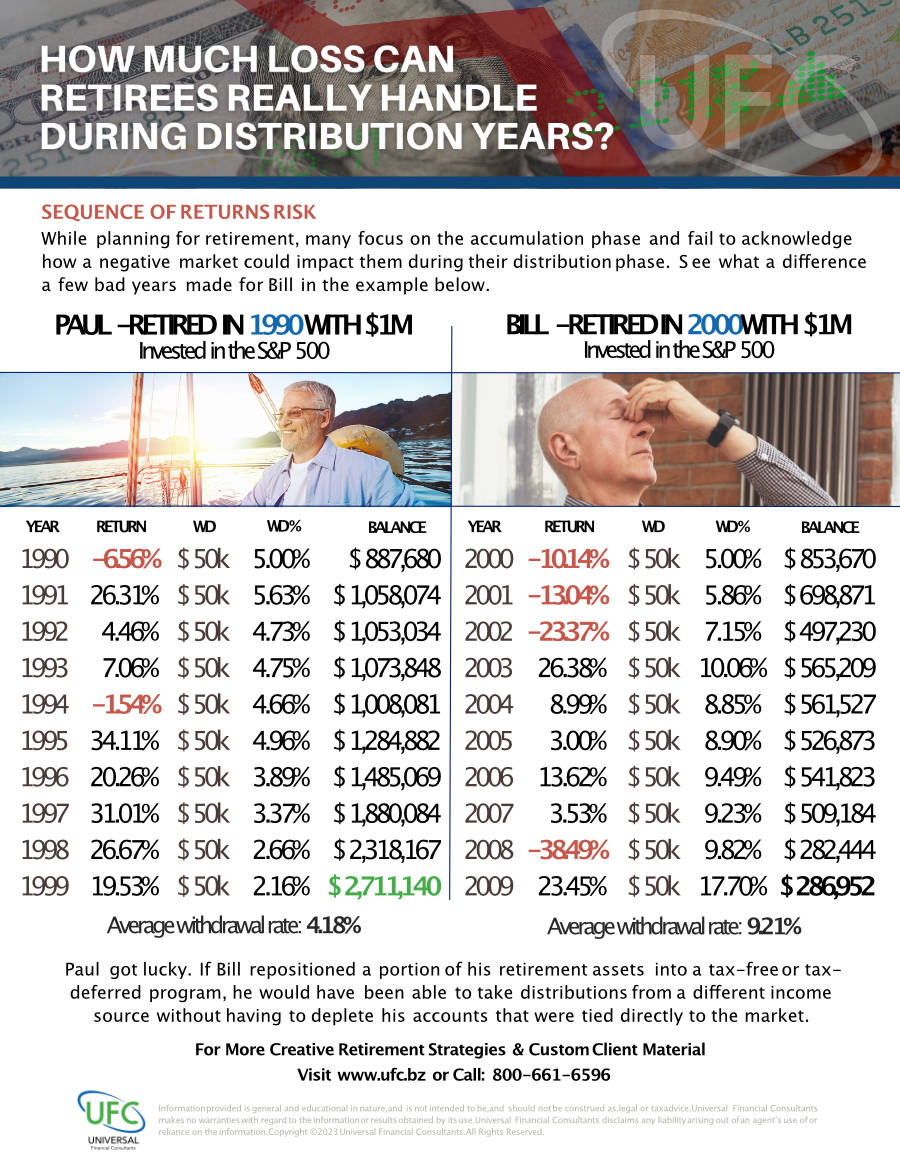

Sequence of returns risk

Paul retired in 1990 with $1M in his account that was invested in the S&P 500.

Bill started out the same, but his ending values looked much different since he retired in 2000 and had much different luck than Paul.

While planning for retirement, many focus on the accumulation phase and fail to acknowledge how a negative market could impact them during their distribution phase. See what a difference a few bad years made for Bill in the example below.

For the full PDF: