Three Reasons to Consider Municipal Bonds

From: www.lordabbett.com

Lord Abbett muni-bond experts highlight current trends in credit quality, supply/demand dynamics, and relative valuations

In a recent webinar with investors, a panel of Lord Abbett experts, including Partner and Director of Tax-Free Fixed Income Dan Solender, Portfolio Manager Greg Shuman, and Director of Municipal Bond Research Eric Friedland, outlined some reasons why municipal bonds remain a potentially attractive asset class for investors seeking tax-free income in the months and years ahead.

1. Historically Stable Credit Quality

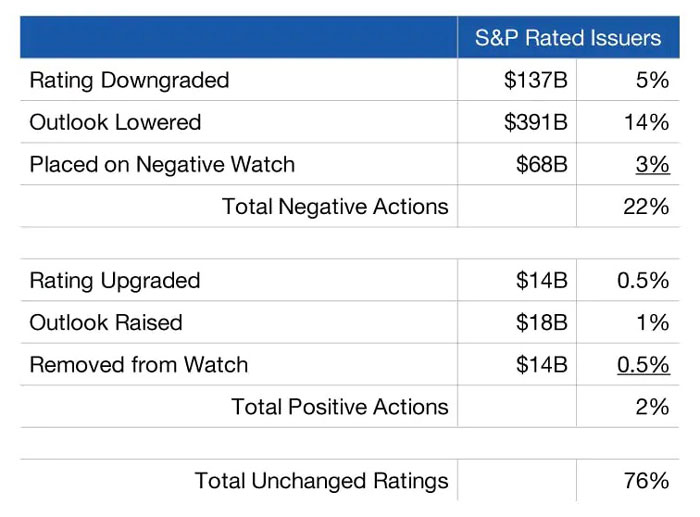

During the pandemic-fueled economic turmoil that characterized 2020, municipal credit quality held up relatively well, in our view. Figure 1 provides a window on this by looking at S&P rating actions in 2020 (through September 30) across approximately $2.7 trillion in municipal credit securities.

Figure 1. S&P Municipal Credit Rating and Outlook Changes During 2020.

Source: S&P Global Ratings. Data as of 9/30/20 (most recent available). S&P Global Ratings is a U.S.-based credit rating agency and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities.

To be sure, 22% of the ratings actions were negative, but a closer look reveals that only 5% of them were actual rating downgrades—the others were largely outlook changes. Another significant data point, in our view, is in the bottom right-hand corner, which shows that unchanged ratings, or affirmations, accounted for 76% of S&P’s rating actions. To us, that underscores our point that there was stability in muni credit quality last year.

Of course, there may be more downgrades to come in 2021 and 2022, but we do not believe the numbers will be anywhere close to market expectations from earlier in the pandemic crisis.

2. A Positive Supply/Demand Dynamic

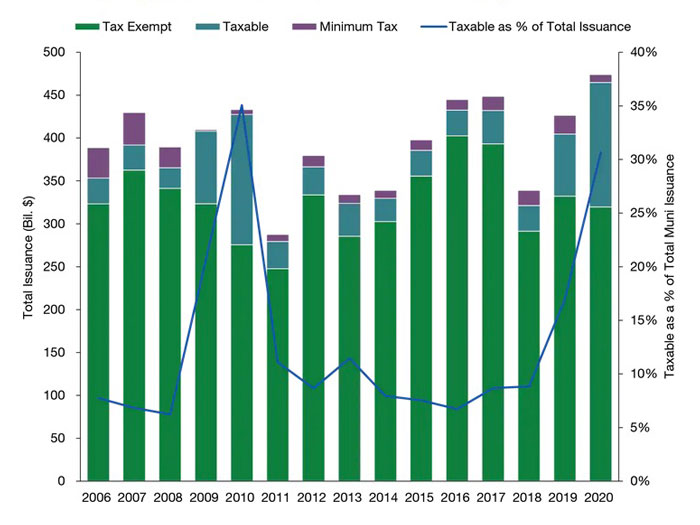

We believe the supply/demand situation in the municipal bond market looks attractive. Figure 3 shows that while municipal bond issuance in 2020 reached a record, an increasing share of the total was from taxable municipal bonds. The amount of tax-exempt municipal bonds issued declined from the prior year.

Figure 2. Muni Issuance Has Climbed – but Taxable Bonds Are Accounting for a Greater Share. New issuance by category (bars) and taxable bonds as a percent of total muni issuance (line), 2005 – 2020.

Source: Bond Buyer, as of December 31, 2020. The historical data are for illustrative purposes only, and do not represent any specific portfolio managed by Lord Abbett or any particular investment.

As a reminder, the increased issuance of taxable muni bonds reflects provisions from the 2017 U.S. tax legislation related to the refunding and refinancing of municipal bonds. And absent any significant change in U.S. tax policy, the trend of higher issuance of taxable muni bonds does not appear to be changing anytime soon.

We think the implications for the tax-exempt side of the market are clear: the current strong demand, and slower pace of new issuance, for tax-exempt municipal bonds could potentially help support the market for some time to come.

3. Opportunities in Lower-Rated Issues

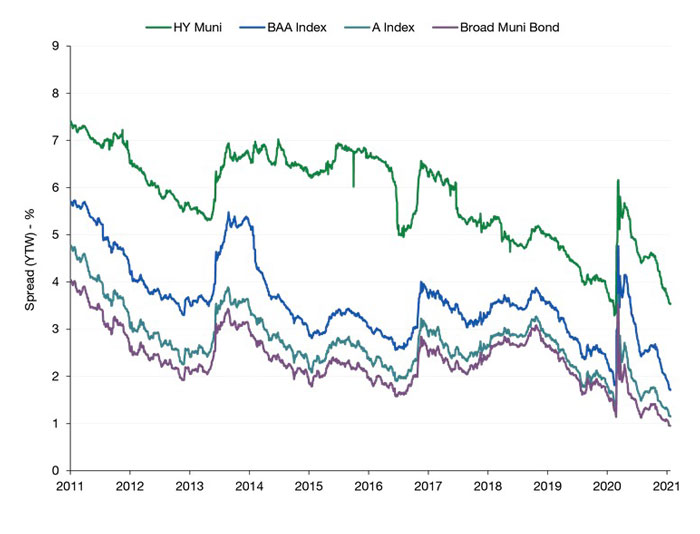

We are often asked where we are finding potential value in the municipal bond market. To answer that, we think the information in Figure 3 is helpful.

Figure 3. A Closer Look at Muni-Bond Spreads. Credit spreads by rating category, February 1, 2011-February 4, 2021.

Source: Bloomberg. Data as of 02/04/2021. Spread is the percentage difference in current yields of various classes of fixed-income securities versus Treasury bonds or another benchmark bond measure. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. Chart displays the Bloomberg Barclays High Yield Municipal Bond Index, Bloomberg Barclays BAA-Rated Municipal Bond Index, Bloomberg Barclays A-Rated Municipal Bond Index, and Bloomberg Barclays Municipal Bond Index (Broad Muni Bond). The historical data shown in the chart above are for illustrative purposes only and do not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment. Past performance is no guarantee of future results.

The chart shows that spreads on A- and BBB-rated bonds have roughly returned to where they were at the end of February 2020. As you go down in quality one more notch, the high yield muni segment was still about 25 basis points wider.

And while on a historical basis, spreads appear relatively tight, we think that you must look at these levels in the context of broader capital markets. Many other asset classes have recovered to pre-pandemic levels, or in fact are trading through where they were before the pandemic started. Even with the strong recovery posted by muni bonds from the 2020 volatility, their gains have trailed those of other investments. We think that as investors recognize the potential relative value on offer in the muni market, especially in the BBB and high-yield segments, the market may have an opportunity to narrow that gap in 2021.