Convertible Bond Issuance Is Soaring

From: www.lazardassetmanagement.com

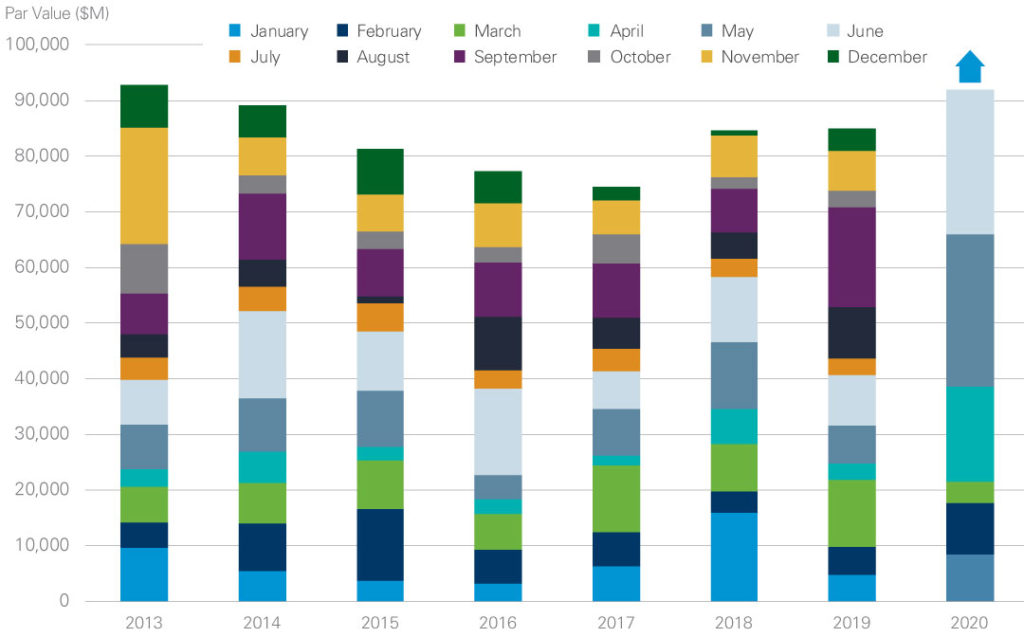

Issuance of convertible bonds has soared since COVID-19 brought a new driver of volatility to financial markets. Issuance of these fixed income securities, which give holders the option to convert their bonds into a predetermined number of equity shares in the same company, had been relatively low since the global financial crisis, but surged in April and May of this year. In fact, a combined $40 billion of new paper came to market in April and May, which is about 400% higher than historical monthly averages (see Exhibit). If the current pace continues, 2020 will be a record year for issuance.

2020 Could Be A Record Year for Global Convertible Issuance

Global Convertible Bond Issuance

As of 30 June 2020

For illustrative purposes only

Source: Bank of America

Why has issuance grown so fast? Government-mandated lockdowns and changes in consumer behavior hit small- and mid-cap growth companies in the retail, leisure, and service industries particularly hard. The stocks of many of these companies fell between 40% and 50% in March. Unlike issuing non-convertible bonds, which can often have very restrictive covenants around capital structure adjustments or are limited by EBITDA requirements, and could require some time to come to market, issuing convertible bonds can allow small- and mid-cap companies to raise capital and finance in as little as 24 hours. Convertible bonds also allow these companies to sell their stock at a premium, while funding their coupon payments at dramatically lower levels than they would be able to if they were to issue traditional bonds (high yield bonds, for example). Issuers have also been able to take advantage of an increase in demand from institutional investors who are adjusting their risk preferences and as such are looking for the combination of coupon payments and return of principal at maturity that convertible bonds provide, while still offering the upside potential of their underlying stocks.

However, because of the massive levels of issuance, the repricing of risk in the second quarter, and the enhanced value of the convertible’s option, associated with higher volatility, these primary deals are now coming to market at dramatically cheaper levels than is typical–close to the cheapest that the team has seen in the last 25 years. Currently, investment grade issuers are pricing hedged convertibles at an absolute return potential (the Implied Credit Spread, or ICRD) of 500 to 800 basis points (bps) over the risk-free rate (i.e. US Treasuries), while high yield issuers are pricing at absolute return potentials (ICRD) of 750 to 2,000 bps over the risk-free rate.