Rebalancing: The diversification defense

From: vanguard.com

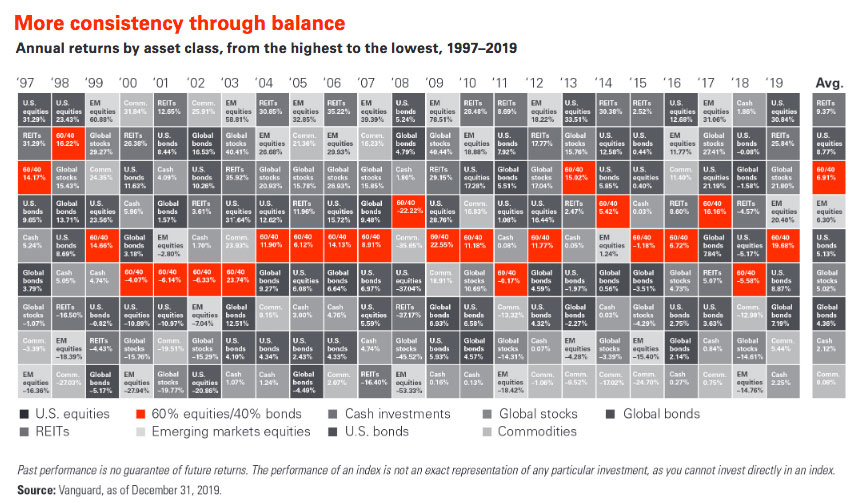

How rebalancing can help your portfolio weather volatility

Watching your portfolio’s returns go up and down can be an emotionally trying experience. Rebalancing to a predetermined, diversified asset mix makes it so you don’t have to worry about market instability as much. When you maintain the appropriate asset allocation, it can serve as a buffer against extreme swings in the market. As a result, you can feel more confident about your portfolio’s ability to potentially preserve value in turbulent markets.

The chart below illustrates the point. Looking to the rightmost column of the chart, clearly the 60% stock, 40% bond (60/40) portfolio does not provide the highest long-term return. But over time, it emerges as being among the top few outperformers.