Missing The Best Days

From: Brookstone Capital Management

Beginning in late February, the market began to exhibit wide daily swings. This happens in markets from time to time and is something that we anticipate when we construct portfolios. These wide swings lead to some short-term price dislocations, but as things calm down (and they will), an investor is likely to find that sticking to a diversified, risk-appropriate portfolio was the right decision.

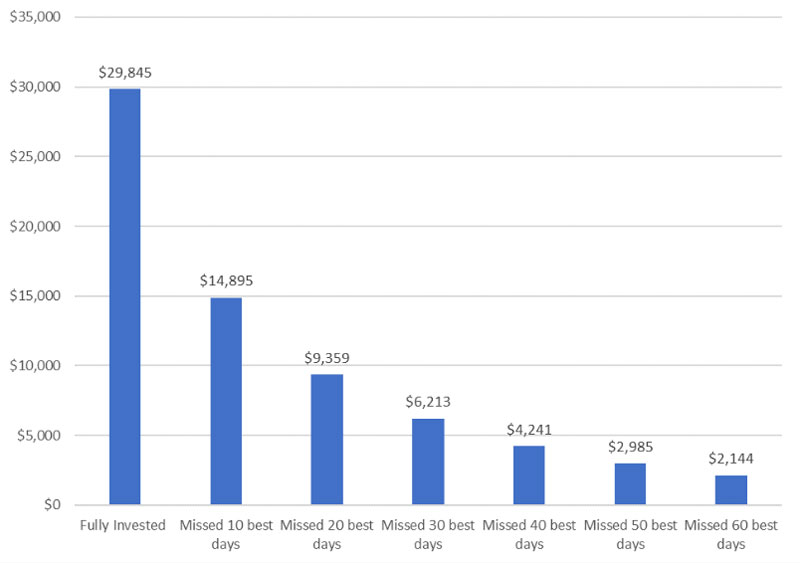

Market history demonstrates that shortly following the market’s worst days are its best days. It may be tempting to try to miss the worst days, but in the long run it might be a risky strategy that exposes an investor to missing the best days!

Missing The Best Days

Chart Reflects $10,000 invested January 4, 1999, through December 31, 2018, with dividends reinvested.

Source: Morningstar Direct, J.P. Morgan Asset Management Returns based on the S&P 500 Total Return Index