Kitces: When and how to deduct long-term care insurance

From: www.financial-planning.com

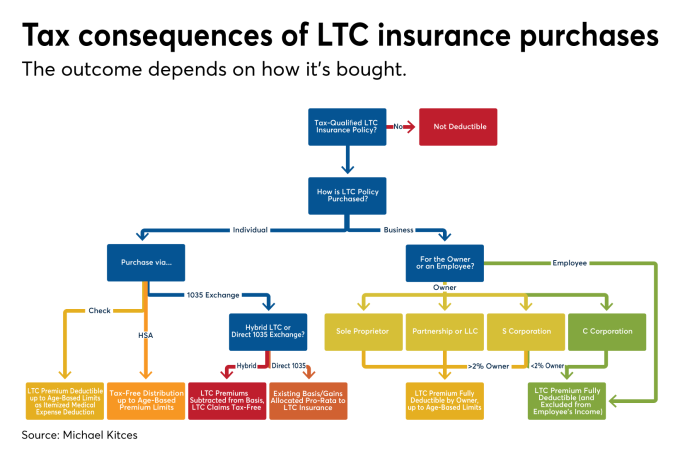

With the 1996 introduction of tax-qualified long-term care insurance under the Health Insurance Portability and Accountability Act and IRC Section 7702B, Congress affirmed that long-term care insurance benefits should be tax-free. Tax benefits for purchased long-term care insurance coverage followed.

However, the evolving landscape of both individual tax deductions and long-term care insurance tax preferences have created myriad options for filers, all of them confusing. What follows is a run-through of the choices, benefits — and indeed, drawbacks — of each.

Deducting Individual Premiums

Under IRC Section 213(d)(1)(D), premiums for long-term care insurance, or LTCI, are deductible along with other individual medical expenses.

To be eligible for deductibility, the LTCI must be tax-qualified coverage as defined under IRC Section 7702B(b), though in practice virtually all LTCI issued today — and really over the past 20 years — is tax-qualified. Non-tax-qualified LTCI is primarily characterized by either not requiring a minimum activities of daily living restriction, or being more lax in the certification requirements to be eligible for claims.

Premiums paid for tax-qualified LTCI are deductible if paid for the individual taxpayer themselves, spouses or any dependent as defined under IRC Section 152. This can include both dependent children and even dependent parents if they otherwise qualify as dependents for tax purposes, and without regard to the must-be-unmarried or income tests that otherwise apply to a qualifying relative dependent.