How (And Why) Volatility Can Ruin Your Retirement

From: riverbendinvestments.com

A common mistake investors make is assuming a certain rate of return and not understanding the impact it has on their portfolio growth.

Investors typically “reach for performance” within their investment accounts. Which is what we are suppose to do. Right?

Well, not exactly…

While trying to obtain the best rate of return sounds like a good idea for an investment portfolio, the added volatility can actually hurt you in the long run –even if you factor in some “above average” rates of return.

Understanding Your Actual Rate Of Return

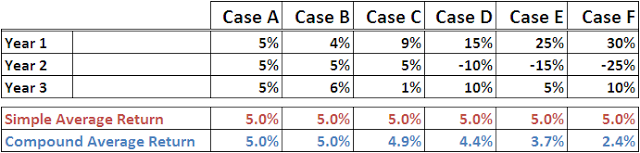

A common assumption I often see among investors is they will assume a certain average rate of return, but not fully understand the impact it has on their portfolio growth. This is illustrated with the chart below:

Source: Crestmont Research

If you look closely, you’ll notice the negative impact volatility has on investment returns.

In case “A” and case “F” the simple average return is 5% (the simple average return is the sum of three years divided by 3). However, the compounded average returns are vastly different.

This is due to gremlins. More precisely volatility gremlins.

Volatility Gremlins

The term ‘volatility gremlins’ was coined by Ed Easterling of Crestmont Research to describe how volatility impacts the growth of investment portfolios.

These volatility gremlins can wreak havoc in your future retirement plan.

For example, you may hear that markets have gone up by 8% per year, but you’ve only seen 5%.

or

Your financial plan might say you can safely take $90,000 per year in retirement income, but your nest egg is shrinking more quickly than expected.

What is happening?

This is a concept that confuses many investors and unfortunately can really hurt their future retirement plans.

In case “E” an investor has returns of 5%, -15%, and 25% over three years, and has an average return over the 3 years of 5% per year. Many investors would be happy with this, as they may feel that the 25% rate of return in year three more than makes up for the previous year’s poor return.

However, the compound return is just 3.7%. — which translates into 1.3% per year less, or over 25% of the returns of case “A”!